Enabling Secure Open Banking Connectivity Across Europe

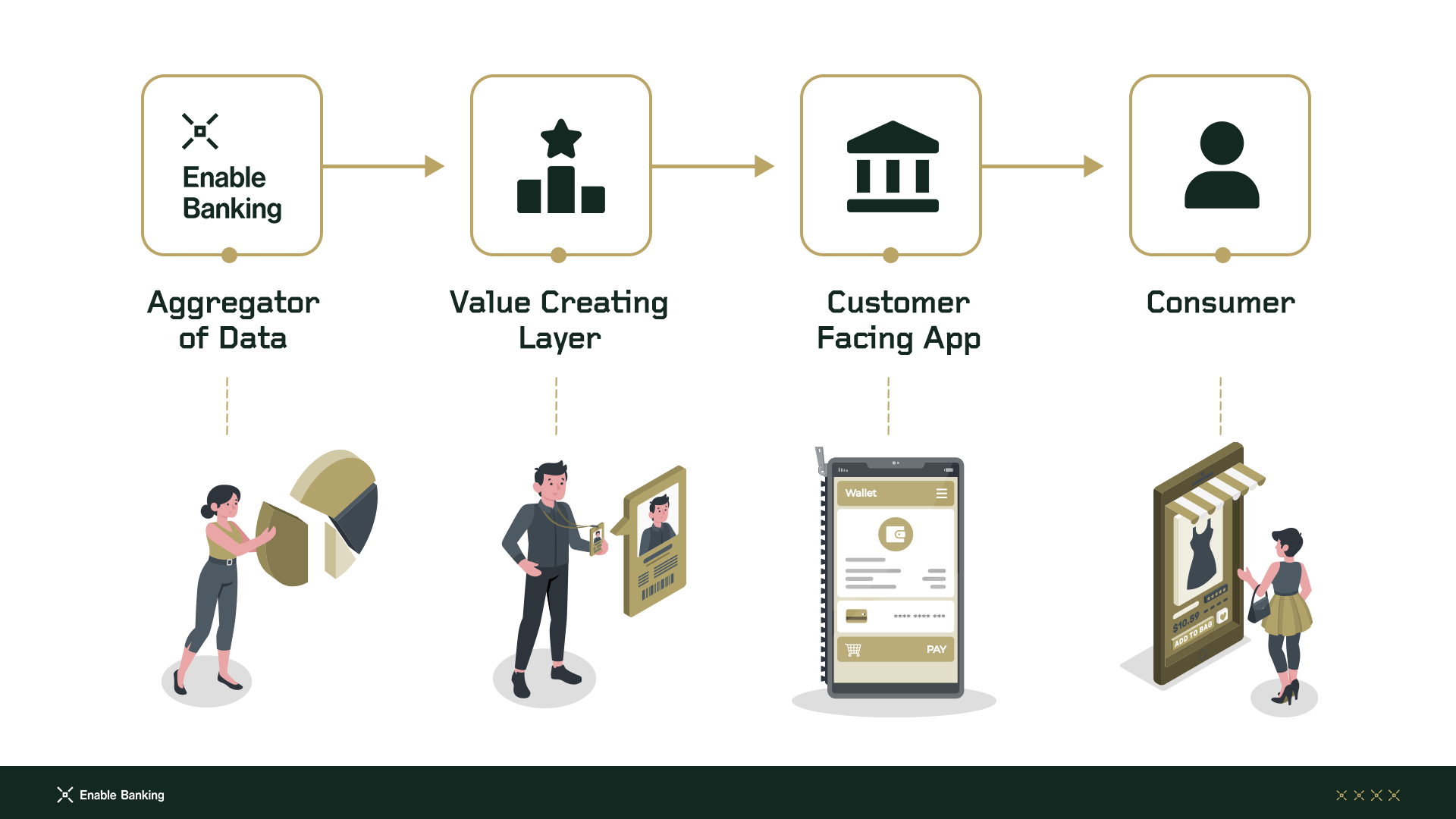

We make complex connectivity simple. Our PSD2 API-only approach for both business and consumer accounts enables companies to access open banking data and initiate payments effortlessly.

Our Story

Since 2019, we have been transforming the possibilities of open banking data. Our RESTful API is live in 29 European countries, connecting you with over 2,500 banks. Through our secure and non-intrusive approach, we bridge the gap between companies and the financial data they need to thrive.

We empower organizations—from financial institutions to ERP providers and loyalty programs—to create intelligent tools for analytics, forecasting, personalization, and risk management. Our technology simplifies the enhancement of your solutions, enabling the automation of processes, discovery of insights, and the delivery of exceptional customer experiences. With unwavering commitment to transparency, security, and trust, we ensure our solutions are fully compliant with European regulations.

Your data, your control

When sending letters or parcels, most people don’t spend much time considering which delivery service to use. But what about sending exclusive jewellery or a painting?

Your financial data is one of the most valuable pieces of information you can trust someone with. At Enable Banking, we treat your open banking data with the same care as if it were our own. We understand that each every company has its unique goals, which is why we focus on being a neutral and non-intrusive provider of open banking connectivity. We do not monetize your data, build products on top of it, or interfere with your business model. Instead, we provide the reliable PSD2 infrastructure you need to innovate and grow on your own terms.

29

European Countries

100+

Partners

2500+

Banks

How it Works

Inform Yourself

Read your preferred partner solution’s terms of service and inform yourself about the details of using their products.

Grant Us Consent

We’ll need your explicit permission to connect your bank accounts to the solutions of your choice. We promise to not even take a peek.

Access New Opportunities

Leverage data to access new financial services opportunities and let the solution of your choice work for you!

Open Banking Use Cases

There are infinite use cases for open banking in an ecosystem where financial services are continuously being improved. Here are a few of the ones we enable:

Invoicing

Automatically load your financial transactions data to invoice with ease. This makes invoicing significantly easier for freelancers, independent contractors, and business owners everywhere.

Real-time open banking data for lenders and providers of risk decisioning solutions. Harness the full potential of Open Banking for smarter assessments in your credit risk models. Learn more.

Automated Bookkeeping

Elevate your ERP with the most comprehensive open banking business account connectivity. Build automated data fetching for transaction analysis, expense tracking, onboarding, and more. More here.

Credit Risk Asessment

Loyalty and Rewards Programs

Enhance your loyalty programs with open banking data. Create loyalty and rewards programs that delight your customers and build long-term loyalty with open banking. Read more.

Questions About Your Data or Security? Get in Touch Below!

If you have any questions or wish to review or revoke your data-sharing consents, please contact us. At Enable Banking, your data's security and your trust are our top priorities.

Manage Your Enable Banking Data Sharing Consents

You have control over the external services that access your payment account data via the Enable Banking API. If you’d like to review or revoke access, please visit this page.