Enable Banking Changelog | July 2024

As always if you have any questions, feel free to reach out to us at support.api@enablebanking.com.

Recognising Payment Authorisations Cancelled on the Banks' Side

We've enhanced our payment authorization handling to accurately recognize when a user cancels a payment on the bank’s page. Previously marked as "Rejected," these transactions are now correctly identified as "Cancelled."

Here's a detailed look at the improvements:

Callback URL Parameter: When the end user returns to the application where the payment was initiated, the query string in the callback URL will include`error=access_denied`, indicating a cancelled payment.

Payment Status: The status returned in response to a `GET /payments/{paymentId}` request will be `CNCL`. This status will also be visible in the request logs within the Control Panel.

These changes ensure that cancelled payments are accurately tracked and reported, providing a clearer picture of payment outcomes.

Control Panel updates

Traffic Level Indication on the ASPSP Status Page

We've enhanced the Account Servicing Payment Service Providers (ASPSP) status page by adding traffic level indicators for each integration. These indicators, categorised as low, medium, and high, offer insights into the current traffic volumes of an integration. Understanding these traffic levels helps assess the potential impact of any issues caused by problems within the integration or the ASPSP's API.

Improved Performance of the ASPSP Status Page

Significant improvements have been made to the ASPSP status page's performance. Previously, the page experienced long loading times and occasional crashes. The updated version optimises the page structure, resolving these issues. While the initial loading time is slightly longer, country-specific connection statuses now load much faster. This is particularly noticeable for countries with many connectors, like Germany, which now load almost instantaneously.

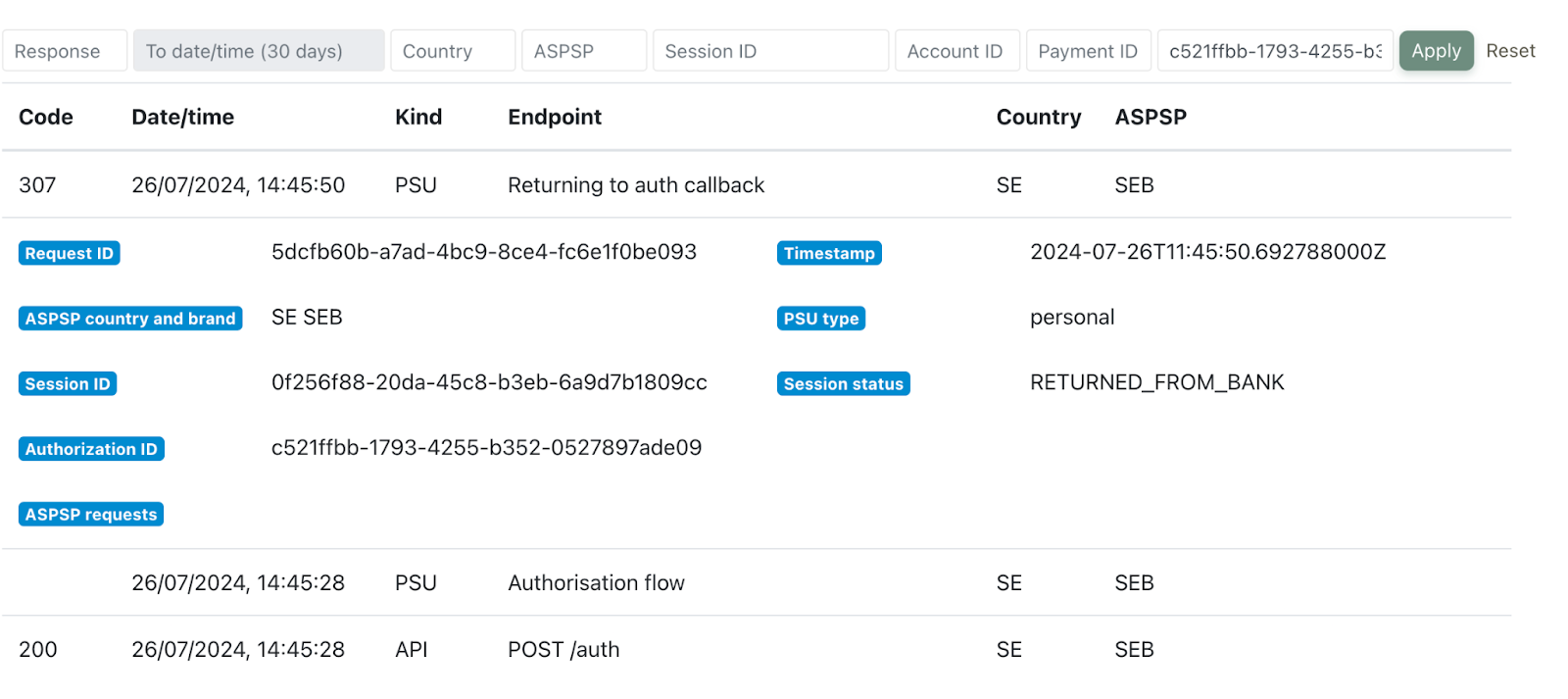

Enhanced Search Functionality for Application Request Logs

The search functionality in the application request logs has been upgraded. Previously, "Returning to auth callback" log entries could only be found by first locating the authorization flow using the authorization ID, and then copying the session ID to search for the callback entry. Now, when searching by an authorization ID, the Control Panel will also display the "Returning to auth callback" log entries if the end-user has returned from the ASPSP’s authorization flow. This enhancement streamlines the search process and improves efficiency.

Core aggregation updates

Special Handling for Scientific Notation in JSON Parser: We've improved the JSON parser to handle scientific notation correctly and always serialise decimals with a decimal point. This ensures accurate data representation and consistency in processing.

Filtering Transactions with Unexpected Status: Transactions with unexpected statuses are now filtered out if a specific transactionStatus is provided, ensuring cleaner and more reliable transaction data.

PaymentNotAccessibleException: We've introduced the PaymentNotAccessibleException to handle situations where the payment status cannot be fetched anymore, providing a clearer error-handling mechanism.

Integration updates

Our ongoing efforts to refine and expand our integration network ensure robust and efficient banking solutions. Check out the latest updates across our connectors.

New integrations

Fiditalia (IT): AIS integration

DKB (DE): AIS and PIS integration towards the new API of DKB

Fixed and improved integrations

Alisa Bank (EU): Added entryReference field to transaction response

Alisa Bank (EU): Changed supported PSU type to personal only as the bank doesn't allow authorisation of access to business accounts through their PSD2 API

Consors Finanz (DE): Disabled PIS and the bank only provide card accounts

DKB (DE): Fixed app token handling when fetching the payment status

HypoVereinsbank (DE): Improved payment status mapping

German Cooperative Financial Group (DE): Fixed sandbox integration for payments

ING (AT, BE, CZ, DE, ES, IT, LU, NL, RO): Enable previously unsupported countries

ING (AT, BE, CZ, DE, ES, IT, LU, NL, RO): Fixed payment status fetching

ING (DE): Returning debtor account and name for executed payments

ING Bank Śląski (PL): Improve error response handling

Kutxabank (ES): Fixed AIS integration

Lazard Frères Banque (FR): ): Disabled PIS as the bank does only provide card accounts

Milleis Banque (FR): Disabled PIS as the bank does only provide card accounts

N26 (EU): Returning null payment status for unconfirmed payments

N26 (EU): Handling the situation when payment status can not be fetched anymore

N26 (EU): Improved payment status mapping

Nordea (DK, FI, NO, SE): Fixed decoupled authorisation for business accounts

Nykredit Bank (DK): Handling expired consent error

Paysera (LT): Added transaction pagination

Paysera (LT): Improved token refresh logic to fix session persistence

SEB (SE): Handling background/online data fetching based on PSU headers

Société Générale Global Cash (EU): Fixed issues with authorisation

Sparkasse (DE): Fix creating payment consent

Svea Bank (SE): Raise TransactionPeriodException in get transactions in case of timeout error due to long period of transactions

Integrations extended

AXA (BE), Bank De Krediet (BE), Bank Van Breda (BE), Banque CPH (BE), Bpost Bank (BE), Comdirect (DE), Commerzbank (DE), Europabank (BE), Nagelmackers (BE): Added integration for INST_SEPA payments

Integrations removed

Broager Sparekasse (DK): Removed as after merging with Frøs Sparekasse, the API of Broager Sparekasse became unavailable

CTT (PT): Removed due to transition to a new platform provider

Hemne Sparebank (NO), Åfjord Sparebank (NO): Removed due to merge into Trøndelag Sparebank

Targobank (ES): Removed as after merging with Abanca, the API of Targobank became unavailable

This month’s Open Banking updates focus on performance, scalability, and payment functionality. Highlights include a 10× improvement in infrastructure spin-up time, expanded bulk domestic payment support in Sweden, improved PSU header validation, and enhanced payment endpoint responses for TPPs.