enable:Banking SDK

Welcome to Enable Banking SDK developer documentation! We are happy that you are interested our solution. In this documentation you have all information to start use our SDK.

Enable Banking SDK is for connecting your solution to Open Banking APIs without 3rd party solutions. With our solution you can build new business driven solutions and also connect your current solution to Open Banking APIs. We are believer for easy and fast development so we offer all needed documentation and code examples for you.

For starting you need to have developer license which you can order here. You will get your developer SDK, which is connected Open Banking API sandboxes.

Get started by cloning our sample repository

$ git clone https://github.com/enablebanking/OpenBankingJavaExamples

$ git clone https://github.com/enablebanking/OpenBankingJSExamples

$ git clone https://github.com/enablebanking/OpenBankingPythonExamples

In the easiest to get started with the SDK by using our code samples. The complete code samples for Java, Javascript and Python are available under our Github account: https://github.com/enablebanking.

For production usage please contact us or If you just need more info contact us at hello@enablebanking.com

Changelog

0.3.1

Added

- Base connector for banks implementing PolishAPI on KIR platform.

Changed

- [Python] Capitalization of request headers removed to be able to support API backend with case-sensitive handling of the headers.

0.3.0

Changed

-

[Java] UnstructuredRemittanceInformation now uses ArrayList constructor.

-

Parameter

paymentRequestDataof PISP API methodmakePaymentRequestConfirmationremoved and the data is passed insideconfirmationparameter (PaymentRequestConfirmationdata structure now has an option attributepaymentRequest).

0.2.1

Added

- Added

DataRetrievalExceptionandInsufficientScopeExceptionderived fromHttpExceptionto represent particular cases.

0.2.0

Added

- [Java] Improved connector settings interface. Added

AbstractConnectorSettingsFactoryclass with a factory methodcreateConnectorSettingsto simplify creation of connector settings.ApiClientnow has constructors takingConnectorSettingsinstance instead of list of settings objects. - [Java]

AbstractPlatformExtensionclass consisting ofsignPKCS1v15usingSHA256andmakeRequestmethods is added in order to simplify customisation of Java platform. Also addedApiClientconstructor takingAbstractPlatformExtensionas a parameter. Transactiondata structure extended with fieldsbankTransactionCode,creditoranddebtorandBankTransactionCodedata structure added.- Value

refresh_tokenis supported forgrant_typeparameter ofmakeTokenmethod.

Changed

- [Java]

ApiClientconstructors accepting settings as a list of objects andJavaPlatformclass are changed toprotected. - Changed order of connector settings. Parameters

consentId,accessTokenandrefreshTokenare now always required (should be set tonullif not present). - [Java] Standard Java SE 8 date-time classes are used instead of ThreeTen-Backport classes, thus Java SE 6 and 7 support is dropped.

- Field

remittanceInformationofTransactionchanged to not required (mainly to support credit card transactions, for which remittance info is usually not provided). Accessdata structure changed:balancesandtransactionsfields contain details for requested access andaccountsfield contains list of accessed account IDs.

Fixed

- Field mapping for Open Banking UK standard is improved.

0.1.x

This version was created before the changelog has been introduced.

SDK reference

Select a language for code samples from the tabs above or the mobile navigation menu.

Currently enable:Banking SDK consists of authorization, account information and payment initiation APIs. The same calls and data structures are used for interacting with different banks. In order to use each of the APIs corresponding API instance needs to be created with bank specific settings.

enable:Banking SDK API is based on STET PSD2 specification.

This API intends to provide an interface for Third Party Providers (TPP) for accessing Account Servicing Payment Service Providers (ASPSP, i.e. banks).

TPP may act as Account Information Service Provider (AISP), Payment Initiation Service Providers (PISP) or both.

The Payment Service User (PSU) is the owner of the accounts held by the ASPSP and gives accreditations to the TPP in order to access his accounts information or initiates payment from these accounts.

License: LicenseRef-LICENSE

Meta API

getConnectors

Code samples

const enablebanking = require('enablebanking');

const metaApi = new enablebanking.MetaApi(new enablebanking.ApiClient());

const connectors = await metaApi.getConnectors({

country: 'FI' // requesting connectors for Finland

});

import enablebanking

meta_api = enablebanking.MetaApi(enablebanking.ApiClient())

connectors = meta_api.get_connectors(

country='FI') # requesting connectors for Finland

import com.enablebanking.*;

import com.enablebanking.model.*;

import com.enablebanking.api.MetaApi;

MetaApi metaApi = new MetaApi(new ApiClient());

HalConnectors connectors = metaApi.getConnectors("FI"); // connectors for Finland

Retrieval of the available connectors

Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| country | string | false | Country ISO code |

Returned value

Data type: HalConnectors

List of connectors

Auth API

getAuth

Code samples

const enablebanking = require('enablebanking');

const authApi = new enablebanking.AuthApi(

new enablebanking.ApiClient('Bank name', [ /* Bank settings */ ]));

const { url } = await authApi.getAuth(

'code', // using authorization code grant

'https://example.com/', // redirect URL

['aisp'], // API scope

{

state: 'test' // state to pass to redirect URL

});

import enablebanking

auth_api = enablebanking.AuthApi(enablebanking.ApiClient(

'Bank name',

{

# Bank settings

})

url = auth_api.get_auth(

'code', # using authorization code grant

'https://example.com/', # redirect URL

['aisp'], # API scope

state='test', # state to pass to redirect URL

).url

import java.util.List;

import java.util.ArrayList;

import java.util.Arrays;

import com.enablebanking.ApiClient;

import com.enablebanking.model.*;

import com.enablebanking.api.AuthApi;

List bankSettings = new ArrayList();

// Filling in bank settings here...

AuthApi authApi = new AuthApi(new ApiClient("Bank name", bankSettings));

String url = authApi.getAuth(

"code", // using authorization code grant

"https://example.com/", // redirect URL

new ArrayList(Arrays.asList("aisp")), // API scope

"test", // state to pass to redirect URL

null // not passing access request (bank's defaults will be used)

).url;

Request Authorization Data

Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| response_type | string | true | none |

| redirect_uri | string | true | none |

| scope | array[string] | true | none |

| state | string | false | none |

| access | Access | false | Contains request for access to account information. |

Detailed descriptions

access: Contains request for access to account information.

This parameter should be set to override defaults for the banks, which allow PSUs to give consent for account information sharing right after authentication.

Enumerated Values

response_type

| Value | Description |

|---|---|

| code | — |

scope

| Value | Description |

|---|---|

| aisp | Access AISP (account information) APIs |

| pisp | Access PISP (payment initiation) APIs |

Returned value

Data type: Auth

Authorization Data

Exceptions

| Data type | Description |

|---|---|

| HttpException | Raised when ASPSP API responses with unspecified error. |

makeToken

Code samples

const enablebanking = require('enablebanking');

const authApi = new enablebanking.AuthApi(

new enablebanking.ApiClient('Bank name', [ /* Bank settings */ ]));

const token = await authApi.makeToken(

'authorization_code', // grant type, MUST be set to "authorization_code"

'so43ls-3ldg03sd-hl4saa3l2sl5czfhl3'); // The code received in the query string when redirected from authorization

import enablebanking

auth_api = enablebanking.AuthApi(enablebanking.ApiClient(

'Bank name',

{

# Bank settings

})

token = auth_api.make_token(

'authorization_code', # grant type, MUST be set to "authorization_code"

'so43ls-3ldg03sd-hl4saa3l2sl5czfhl3') # The code received in the query string when redirected from authorization

import java.util.List;

import java.util.ArrayList;

import com.enablebanking.ApiClient;

import com.enablebanking.model.*;

import com.enablebanking.api.AuthApi;

List bankSettings = new ArrayList();

// Filling in bank settings here...

AuthApi authApi = new AuthApi(new ApiClient("Bank name", bankSettings));

Token token = authApi.makeToken(

"authorization_code", // grant type, MUST be set to "authorization_code"

"so43ls-3ldg03sd-hl4saa3l2sl5czfhl3" // The code received in the query string when redirected from authorization

);

Request Access Token

Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| grant_type | string | true | Value should be set to authorization_code or refresh_token depending on what |

| code | string | true | Value of either the code received in the query string when redirected from |

| redirect_uri | string | false | Redirect URI supplied to getAuth function for retreival of the |

Detailed descriptions

grant_type: Value should be set to authorization_code or refresh_token depending on what

passed to code parameter.

code: Value of either the code received in the query string when redirected from authorization page or the refresh token used for renewing access token.

redirect_uri: Redirect URI supplied to getAuth function for retreival of the

authorization URL. This parameter is only required for some connectors, but it is

a good practice to pass it in order to unify usage for between different connectors.

Enumerated Values

grant_type

| Value | Description |

|---|---|

| authorization_code | Used to exchange an authorization code for an access token. After the user returns to the client via the redirect URL, the application will get the authorization code from the URL and use it to request an access token. |

| refresh_token | Used to exchange a refresh token for an access token when the access token has expired. This allows clients to continue to have a valid access token without further interaction with the user. Please note that refresh token is likely to be changed when calling `makeToken` with `refresh_token` grant type. |

Returned value

Data type: Token

Authorisation token (Bearer)

Exceptions

| Data type | Description |

|---|---|

| HttpException | Raised when ASPSP API responses with unspecified error. |

getCurrentToken

Code samples

const enablebanking = require('enablebanking');

const authApi = new enablebanking.AuthApi(

new enablebanking.ApiClient('Bank name', [ /* Bank settings */ ]));

const token = await authApi.getCurrentToken();

import enablebanking

auth_api = enablebanking.AuthApi(enablebanking.ApiClient(

'Bank name',

{

# Bank settings

})

token = auth_api.get_current_token()

import java.util.List;

import java.util.ArrayList;

import com.enablebanking.ApiClient;

import com.enablebanking.model.*;

import com.enablebanking.api.AuthApi;

List bankSettings = new ArrayList();

// Filling in bank settings here...

AuthApi authApi = new AuthApi(new ApiClient("Bank name", bankSettings));

Token token = authApi.getCurrentToken();

Get current token data

Returned value

Data type: Token

Current token. Values for some fields might be missing if not used.

AISP API

getAccounts

Code samples

const enablebanking = require('enablebanking');

const aispApi = new enablebanking.AISPApi(

new enablebanking.ApiClient('Bank name', [ /* Bank settings */ ]));

const accounts = await aispApi.getAccounts();

import enablebanking

aisp_api = enablebanking.AISPApi(enablebanking.ApiClient(

'Bank name',

{

# Bank settings

}))

accounts = aisp_api.get_accounts()

import com.enablebanking.ApiClient;

import com.enablebanking.api.AispApi;

import com.enablebanking.model.*;

// To be replaced with real connector settings class and set properties

ConnectorSettings connectorSettings = new SomeBankConnectorSettings();

AispApi aispApi = new AispApi(new ApiClient(connectorSettings));

HalAccounts accounts = aispApi.getAccounts();

Retrieval of the PSU accounts (AISP)

Description

This call returns all payment accounts that are relevant the PSU on behalf of whom the AISP is connected. Thanks to HYPERMEDIA, each account is returned with the links aiming to ease access to the relevant transactions and balances. The result may be subject to pagination (i.e. retrieving a partial result in case of having too many results) through a set of pages by the ASPSP. Thereafter, the AISP may ask for the first, next, previous or last page of results.Prerequisites

- The TPP has been registered by the Registration Authority for the AISP role.

- The TPP and the PSU have a contract that has been enrolled by the ASPSP

- At this step, the ASPSP has delivered an OAUTH2 "Authorization Code" or "Resource Owner Password" access token to the TPP (cf. § 3.4.2).

- The TPP and the ASPSP have successfully processed a mutual check and authentication

- The TPP has presented its OAUTH2 "Authorization Code" or "Resource Owner Password" access token which allows the ASPSP to identify the relevant PSU and retrieve the linked PSU context (cf. § 3.4.2) if any.

- The ASPSP takes into account the access token that establishes the link between the PSU and the AISP.

Business Flow

The TPP sends a request to the ASPSP for retrieving the list of the PSU payment accounts. The ASPSP computes the relevant PSU accounts and builds the answer as an accounts list. The result may be subject to pagination in order to avoid an excessive result set. Each payment account will be provided with its characteristics.Returned value

Data type: HalAccounts

Returned value consists of the list of the accounts that have been made available to the AISP by the PSU and HYPERMEDIA links to the related resources provided by ASPSP through the API.

Exceptions

| Data type | Description |

|---|---|

| HttpException | Raised when ASPSP API responses with unspecified error. |

| DataRetrievalException | Raised when unable to retrieve data requested from ASPSP API. |

| InsufficientScopeException | Raised when consent given by the PSU does not allow to retrieve requested data. |

getAccountBalances

Code samples

const enablebanking = require('enablebanking');

const aispApi = new enablebanking.AISPApi(

new enablebanking.ApiClient('Bank name', [ /* Bank settings */ ]));

const balances = await aispApi.getAccountBalances('203059694928560295396833');

import enablebanking

aisp_api = enablebanking.AISPApi(enablebanking.ApiClient(

'Bank name',

{

# Bank settings

}))

balances = aisp_api.get_account_balances('203059694928560295396833')

import com.enablebanking.ApiClient;

import com.enablebanking.api.AispApi;

import com.enablebanking.model.*;

// To be replaced with real connector settings class and set properties

ConnectorSettings connectorSettings = new SomeBankConnectorSettings();

AispApi aispApi = new AispApi(new ApiClient(connectorSettings));

HalBalances balances = aispApi.getAccountBalances("203059694928560295396833")

Retrieval of an account balances report (AISP)

Description

This call returns a set of balances for a given PSU account that is specified by the AISP through an account resource Identification- The ASPSP must provide at least the accounting balance on the account.

- The ASPSP can provide other balance restitutions, e.g. instant balance, as well, if possible.

- Actually, from the PSD2 perspective, any other balances that are provided through the Web-Banking service of the ASPSP must also be provided by this ASPSP through the API.

Prerequisites

- The TPP has been registered by the Registration Authority for the AISP role

- The TPP and the PSU have a contract that has been enrolled by the ASPSP

- At this step, the ASPSP has delivered an OAUTH2 “Authorization Code” or “Resource Owner Password” access token to the TPP (cf. § 3.4.2).

- The TPP and the ASPSP have successfully processed a mutual check and authentication

- The TPP has presented its OAUTH2 “Authorization Code” or “Resource Owner Password” access token which allows the ASPSP to identify the relevant PSU and retrieve the linked PSU context (cf. § 3.4.2) if any.

- The ASPSP takes into account the access token that establishes the link between the PSU and the AISP.

- The TPP has previously retrieved the list of available accounts for the PSU

Business flow

The AISP requests the ASPSP on one of the PSU’s accounts.The ASPSP answers by providing a list of balances on this account.

- The ASPSP must provide at least the accounting balance on the account.

- The ASPSP can provide other balance restitutions, e.g. instant balance, as well, if possible.

- Actually, from the PSD2 perspective, any other balances that are provided through the Web-Banking service of the ASPSP must also be provided by this ASPSP through the API.

Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| accountResourceId | string | true | Identification of account resource to fetch |

Returned value

Data type: HalBalances

Returned value consists of the list of account balances and HYPERMEDIA links to the related resources provided by ASPSP through the API.

Exceptions

| Data type | Description |

|---|---|

| HttpException | Raised when ASPSP API responses with unspecified error. |

| DataRetrievalException | Raised when unable to retrieve data requested from ASPSP API. |

| InsufficientScopeException | Raised when consent given by the PSU does not allow to retrieve requested data. |

getAccountTransactions

Code samples

const enablebanking = require('enablebanking');

const aispApi = new enablebanking.AISPApi(

new enablebanking.ApiClient('Bank name', [ /* Bank settings */ ]));

const transactions = await aispApi.getAccountTransactions('203059694928560295396833');

import enablebanking

aisp_api = enablebanking.AISPApi(enablebanking.ApiClient(

'Bank name',

{

# Bank settings

}))

transactions = aisp_api.get_account_transactions('203059694928560295396833')

import com.enablebanking.ApiClient;

import com.enablebanking.api.AispApi;

import com.enablebanking.model.*;

// To be replaced with real connector settings class and set properties

ConnectorSettings connectorSettings = new SomeBankConnectorSettings();

AispApi aispApi = new AispApi(new ApiClient(connectorSettings));

HalTransactions transactions = aispApi.getAccountTransactions("203059694928560295396833");

Retrieval of an account transaction set (AISP)

Description

This call returns transactions for an account for a given PSU account that is specified by the AISP through an account resource identification. The request may use some filter parameter in order to restrict the query- on a given imputation date range

- past a given incremental technical identification

Prerequisites

- The TPP has been registered by the Registration Authority for the AISP role

- The TPP and the PSU have a contract that has been enrolled by the ASPSP

- At this step, the ASPSP has delivered an OAUTH2 "Authorization Code" or "Resource Owner Password" access token to the TPP (cf. § 3.4.2).

- The TPP and the ASPSP have successfully processed a mutual check and authentication

- The TPP has presented its OAUTH2 "Authorization Code" or "Resource Owner Password" access token which allows the ASPSP to identify the relevant PSU and retrieve the linked PSU context (cf. § 3.4.2) is any.

- The ASPSP takes into account the access token that establishes the link between the PSU and the AISP.

- The TPP has previously retrieved the list of available accounts for the PSU

Business flow

The AISP requests the ASPSP on one of the PSU’s accounts. It may specify some selection criteria. The ASPSP answers by a set of transactions that matches the query. The result may be subject to pagination in order to avoid an excessive result set.Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| accountResourceId | string | true | Identification of account resource to fetch |

| dateFrom | string(date-time) | false | Inclusive minimal imputation date of the transactions. |

| dateTo | string(date-time) | false | Exclusive maximal imputation date of the transactions. |

| afterEntryReference | string | false | Specifies the value on which the result has to be computed. |

| transactionStatus | TransactionStatus | false | Transactions having a transactionStatus equal to this parameter are included within the result. |

Detailed descriptions

dateFrom: Inclusive minimal imputation date of the transactions.

Transactions having an imputation date equal to this parameter are included within the result.

dateTo: Exclusive maximal imputation date of the transactions.

Transactions having an imputation date equal to this parameter are not included within the result.

afterEntryReference: Specifies the value on which the result has to be computed.

Only the transaction having a technical identification greater than this value must be included within the result

Enumerated Values

transactionStatus

| Value | Description |

|---|---|

| BOOK | (ISO20022 ClosingBooked) Accounted transaction |

| CNCL | Cancelled transaction |

| HOLD | Account hold |

| OTHR | Transaction with unknown status or not fitting the other options |

| PDNG | (ISO20022 Expected) Instant Balance Transaction |

| RJCT | Rejected transaction |

| SCHD | Scheduled transaction |

Returned value

Data type: HalTransactions

Complete transactions response

Exceptions

| Data type | Description |

|---|---|

| HttpException | Raised when ASPSP API responses with unspecified error. |

| DataRetrievalException | Raised when unable to retrieve data requested from ASPSP API. |

| InsufficientScopeException | Raised when consent given by the PSU does not allow to retrieve requested data. |

modifyConsents

Code samples

const enablebanking = require('enablebanking');

const aispApi = new enablebanking.AISPApi(

new enablebanking.ApiClient('Bank name', [ /* Bank settings */ ]));

const consent = await aispApi.modifyConsents({

access: {

balances: ['203059694928560295396833'],

transactions: [],

trustedBeneficiaries: false,

psuIdentity: true

}

});

import enablebanking

aisp_api = enablebanking.AISPApi(enablebanking.ApiClient(

'Bank name',

{

# Bank settings

}))

consent = aisp_api.modify_consents(

access=enablebanking.Access(

# default access to balances

balances=enablebanking.BalancesAccess(),

# default access to transactions

transactions=enablebanking.TransacrionsAccess(),

trusted_beneficiaries=False,

psu_identity=True,

),

)

import com.enablebanking.ApiClient;

import com.enablebanking.api.AispApi;

import com.enablebanking.model.*;

// To be replaced with real connector settings class and set properties

ConnectorSettings connectorSettings = new SomeBankConnectorSettings();

AispApi aispApi = new AispApi(new ApiClient(connectorSettings));

Consent consent = aispApi.modifyConsents(

new Access()

.balances(new BalancesAccess()) // default access to balances

.transactions(new TransactionsAccess()) // default access to transactions

.trustedBeneficiaries(false)

.psuIdentity(true));

Forwarding the PSU consent (AISP)

Description

In the mixed detailed consent on accounts- the AISP captures the consent of the PSU

- then it forwards this consent to the ASPSP

Prerequisites

- The TPP has been registered by the Registration Authority for the AISP role.

- The TPP and the PSU have a contract that has been enrolled by the ASPSP

- At this step, the ASPSP has delivered an OAUTH2 "Authorization Code" or "Resource Owner Password" access token to the TPP (cf. § 3.4.2).

- The TPP and the ASPSP have successfully processed a mutual check and authentication

- The TPP has presented its OAUTH2 "Authorization Code" or "Resource Owner Password" access token which allows the ASPSP to identify the relevant PSU and retrieve the linked PSU context (cf. § 3.4.2) if any.

- The ASPSP takes into account the access token that establishes the link between the PSU and the AISP.

Business Flow

The PSU specifies to the AISP which of his/her accounts will be accessible and which functionalities should be available. The AISP forwards these settings to the ASPSP. The ASPSP answers by HTTP201 return code.Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| redirect_uri | string | false | none |

| access | Access | false | List of consents granted to the AISP by the PSU. |

Returned value

Data type: Consent

Created or modified consent

Exceptions

| Data type | Description |

|---|---|

| HttpException | Raised when ASPSP API responses with unspecified error. |

getCurrentConsent

Code samples

const enablebanking = require('enablebanking');

const aispApi = new enablebanking.AISPApi(

new enablebanking.ApiClient('Bank name', [ /* Bank settings */ ]));

const consent = await aispApi.getCurrentConsent();

import enablebanking

aisp_api = enablebanking.AISPApi(enablebanking.ApiClient(

'Bank name',

{

# Bank settings

}))

consent = aisp_api.get_current_consent()

import com.enablebanking.ApiClient;

import com.enablebanking.api.AispApi;

import com.enablebanking.model.*;

// To be replaced with real connector settings class and set properties

ConnectorSettings connectorSettings = new SomeBankConnectorSettings();

AispApi aispApi = new AispApi(new ApiClient(connectorSettings));

Consent consent = aispApi.getCurrentConsent();

Returns current consent (AISP)

Description

Returned value

Data type: Consent

Current consent used for accessing AIS APIs.

PISP API

makePaymentRequest

Code samples

const enablebanking = require('enablebanking');

const pispApi = new enablebanking.PISPApi(

new enablebanking.ApiClient('Bank name', [ /* Bank settings */ ]));

// Making payment request with credit transafer transaction of one element

const requestCreation = await pispApi.makePaymentRequest({

creditTransferTransaction: [{

instructedAmount: {

amount: '12.25', // amount

currency: 'EUR' // currency code

},

beneficiary: {

creditor: {

name: 'Creditor Name' // payee (merchant) name

},

creditorAccount: {

iban: 'FI4966010005485495' // payee account number

}

}

}],

debtor: {

name: 'Debtor Name' // payer (account holder) name

},

debtorAccount: {

iban: 'FI3839390001384700' // payer account number

}

});

import enablebanking

pisp_api = enablebanking.PISPApi(enablebanking.ApiClient(

'Bank name',

{

# Bank settings

}))

# Making payment request with credit transafer transaction of one element

request_creation = pisp_api.make_payment_request(

enablebanking.PaymentRequestResource(

credit_transfer_transaction=[

enablebanking.CreditTransferTransaction(

instructed_amount=enablebanking.AmountType(

amount='12.25', # amount

currency='EUR'), # currency code

beneficiary=enablebanking.Beneficiary(

creditor=enablebanking.PartyIdentification(

name='Creditor Name'), # payee (merchant) name

creditor_account=enablebanking.AccountIdentification(

iban='FI4966010005485495'), # payee account number

),

),

],

debtor=enablebanking.PartyIdentification(

name='Debtor Name'), # payer (account holder) name

debtor_account=enablebanking.AccountIdentification(

iban='FI3839390001384700'), # payer account number

))

import java.math.BigDecimal;

import java.util.Arrays;

import com.enablebanking.ApiClient;

import com.enablebanking.api.PispApi;

import com.enablebanking.model.*;

// To be replaced with real connector settings class and set properties

ConnectorSettings connectorSettings = new SomeBankConnectorSettings();

PispApi pispApi = new PispApi(new ApiClient(connectorSettings));

// Making payment request with credit transafer transaction of one element

HalPaymentRequestCreation requestCreation = pispApi.makePaymentRequest(

new PaymentRequestResource()

.creditTransferTransaction(Arrays.asList(

new CreditTransferTransaction()

.instructedAmount(

new AmountType()

.currency("EUR")

.amount(new BigDecimal("12.25")))

.beneficiary(

new Beneficiary()

.creditor(

new PartyIdentification()

.name("Creditor Name"))

.creditorAccount(

new AccountIdentification()

.iban("FI4966010005485495")))))

.debtor(

new PartyIdentification()

.name("Debtor Name"))

.debtorAccount(

new AccountIdentification()

.iban("FI3839390001384700")));

Payment request initiation (PISP)

Description

The following use cases can be applied:- payment request on behalf of a merchant

- transfer request on behalf of the account's owner

- standing-order request on behalf of the account's owner

Data content

A payment request or a transfer request might embed several payment instructions having- one single execution date or multiple execution dates

- case of one single execution date, this date must be set at the payment level

- case of multiple execution dates, those dates must be set at each payment instruction level

- one single beneficiary or multiple beneficiaries

- case of one single beneficiary, this beneficiary must be set at the payment level

- case of multiple beneficiaries, those beneficiaries must be set at each payment instruction level

- The beneficiary must be set at the payment level

- The standing order specific characteristics (start date, periodicity...) must be set at the instruction level

Prerequisites for all use cases

- The TPP has been registered by the Registration Authority for the PISP role

- The TPP was provided with an OAUTH2 "Client Credential" access token by the ASPSP (cf. § 3.4.3).

- The TPP and the ASPSP have successfully processed a mutual check and authentication

- The TPP has presented its "OAUTH2 Client Credential" access token

Business flow

Payment Request use case

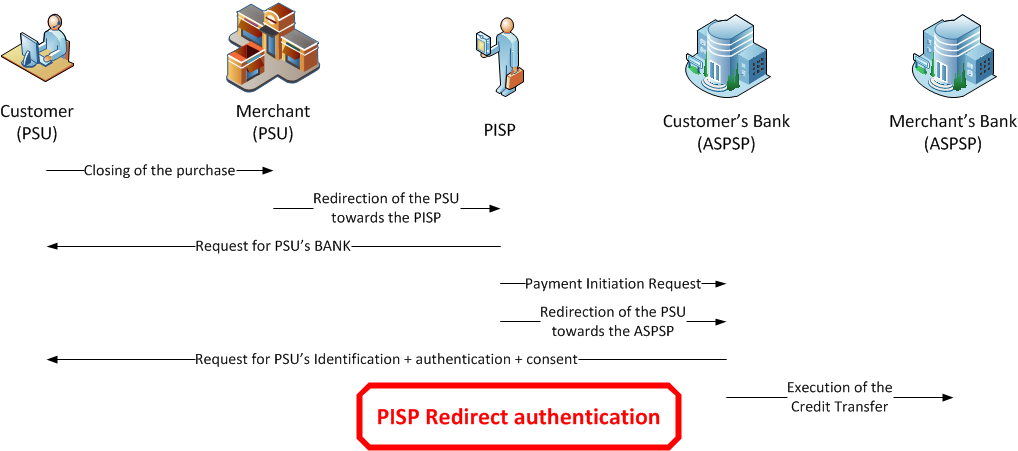

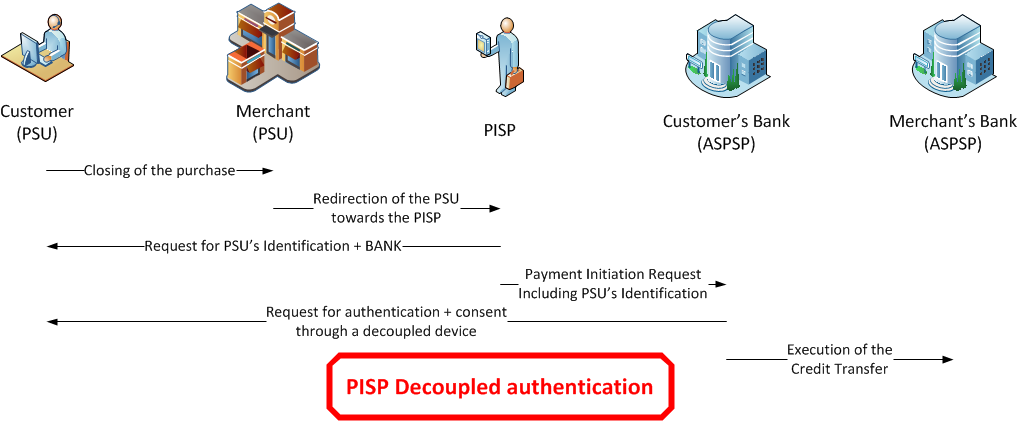

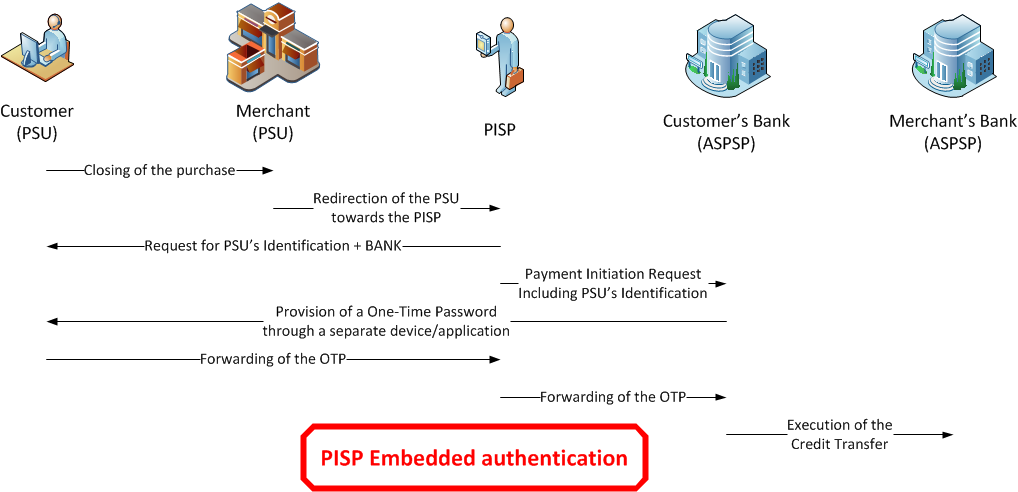

The PISP forwards a payment request on behalf of a merchant.The PSU buys some goods or services on an e-commerce website held by a merchant. Among other payment method, the merchant suggests the use of a PISP service. As there is obviously a contract between the merchant and the PISP, there is no need of such a contract between the PSU and this PISP to initiate the process.

Case of the PSU that chooses to use the PISP service:

- The merchant forwards the requested payment characteristics to the PISP and redirects the PSU to the PISP portal.

- The PISP requests from the PSU which ASPSP will be used.

- The PISP prepares the Payment Request and sends this request to the ASPSP.

- The Request can embed several payment instructions having different requested execution date.

- The beneficiary, as being the merchant, is set at the payment level.

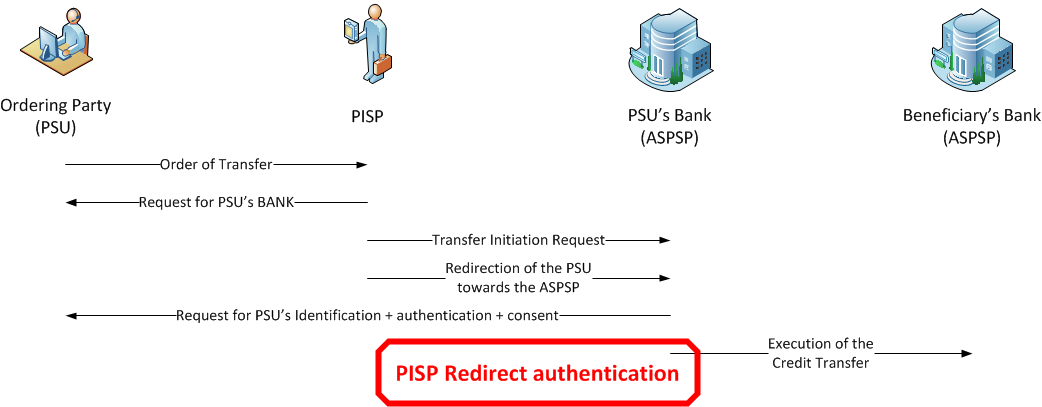

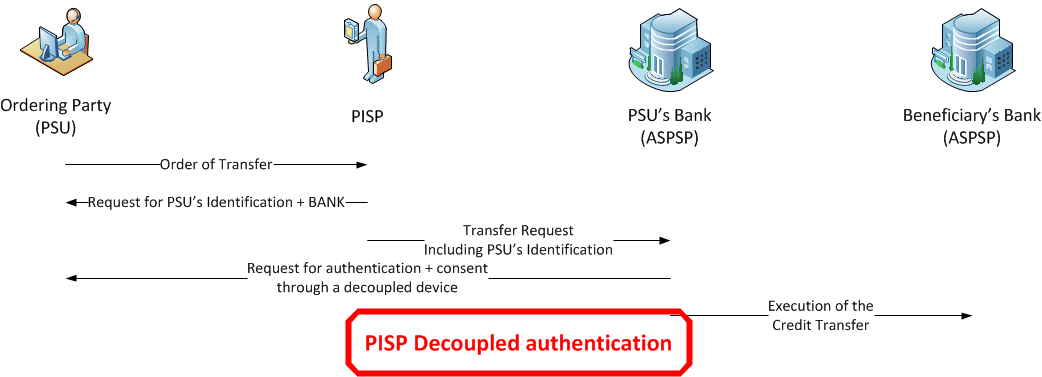

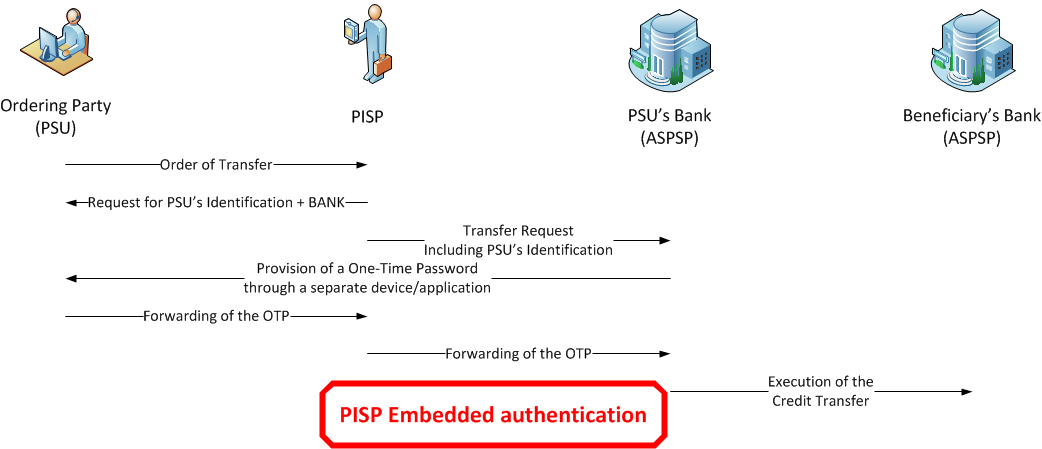

Transfer Request use case

The PISP forwards a transfer request on behalf of the owner of the account.- The PSU provides the PISP with all information needed for the transfer.

- The PISP prepares the Transfer Request and sends this request to the relevant ASPSP that holds the debtor account.

- The Request can embed several payment instructions having different beneficiaries.

- The requested execution date, as being the same for all instructions, is set at the payment level.

Standing Order Request use case

The PISP forwards a Standing Order request on behalf of the owner of the account.- The PSU provides the PISP with all information needed for the Standing Order.

- The PISP prepares the Standing Order Request and sends this request to the relevant ASPSP that holds the debtor account.

- The Request embeds one single payment instruction with

- The requested execution date of the first occurrence

- The requested execution frequency of the payment in order to compute further execution dates

- An execution rule to handle cases when the computed execution dates cannot be processed (e.g. bank holydays)

- An optional end date for closing the standing Order

Authentication flows for all use cases

As the request posted by the PISP to the ASPSP needs a PSU authentication before execution, this request will include:- The specification of the authentication approaches that are supported by the PISP (any combination of "REDIRECT", "EMBEDDED" and "DECOUPLED" values).

- In case of possible REDIRECT or DECOUPLED authentication approach, one or two call-back URLs to be used by the ASPSP at the finalisation of the authentication and consent process :

- The first call-back URL will be called by the ASPSP if the Payment Request is processed without any error or rejection by the PSU

- The second call-back URL is to be used by the ASPSP in case of processing error or rejection by the PSU. Since this second URL is optional, the PISP might not provide it. In this case, the ASPSP will use the same URL for any processing result.

- Both call-back URLS must be used in a TLS-secured request.

- In case of possible "EMBEDDED" or "DECOUPLED" approaches, the PSU identifier that can be processed by the ASPSP for PSU recognition must have been set within the request body [debtor] structure.

- A location link of the saved Request that will be further used to retrieve the Request and its status information.

- The specification of the chosen authentication approach taking into account both the PISP and the PSU capabilities.

- In case of chosen REDIRECT authentication approach, the URL to be used by the PISP for redirecting the PSU in order to perform a authentication.

Redirect authentication approach

When the chosen authentication approach within the ASPSP answers is set to "REDIRECT":- The PISP redirects the PSU to the ASPSP which authenticates the PSU

- The ASPSP asks the PSU to give (or deny) his/her consent to the Payment Request

- The PSU chooses or confirms which of his/her accounts shall be used by the ASPSP for the future Credit Transfer.

- The ASPSP is then able to initiate the subsequent Credit Transfer

- The ASPSP redirects the PSU to the PISP using one of the call-back URLs provided within the posted Payment Request

Decoupled authentication approach

When the chosen authentication approach is "DECOUPLED":- Based on the PSU identifier provided within the Payment Request by the PISP, the ASPSP gives the PSU with the Payment Request details and challenges the PSU for a Strong Customer Authentication on a decoupled device or application.

- The PSU chooses or confirms which of his/her accounts shall be used by the ASPSP for the future Credit Transfer.

- The ASPSP is then able to initiate the subsequent Credit Transfer

- The ASPSP notifies the PISP about the finalisation of the authentication and consent process by using one of the call-back URLs provided within the posted Payment Request

Embedded authentication approach

When the chosen authentication approach within the ASPSP answers is set to "EMBEDDED":- The TPP informs the PSU that a challenge is needed for completing the Payment Request processing. This challenge will be one of the following:

- A One-Time-Password sent by the ASPSP to the PSU on a separate device or application.

- A response computed by a specific device on base of a challenge sent by the ASPSP to the PSU on a separate device or application.

- The PSU unlock the device or application through a "knowledge factor" and/or an "inherence factor" (biometric), retrieves the Payment Request details and processes the data sent by the ASPSP;

- The PSU might choose or confirm which of his/her accounts shall be used by the ASPSP for the future Credit Transfer when the device or application allows it.

- When agreeing the Payment Request, the PSU enters the resulting authentication factor through the PISP interface which will forward it to the ASPSP through a confirmation request (cf. § 4.7)

Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| paymentRequest | PaymentRequestResource | true | ISO20022 based payment Initiation Request |

Returned value

Data type: HalPaymentRequestCreation

The request has been created as a resource. The ASPSP must authenticate the PSU.

Exceptions

| Data type | Description |

|---|---|

| HttpException | Raised when ASPSP API responses with unspecified error. |

getPaymentRequest

Retrieval of a payment request (PISP)

Description

The following use cases can be applied:- retrieval of a payment request on behalf of a merchant

- retrieval of a transfer request on behalf of the account's owner

- retrieval of a standing-order request on behalf of the account's owner

The ASPSP has registered the Request, updated if necessary the relevant identifiers in order to avoid duplicates and returned the location of the updated Request.

The PISP gets the Request that might have been updated with the resource identifiers, the status of the Payment/Transfer Request and the status of the subsequent credit transfer.

Prerequisites

- The TPP has been registered by the Registration Authority for the PISP role

- The TPP was provided with an OAUTH2 "Client Credential" access token by the ASPSP (cf. § 3.4.3).

- The TPP has previously posted a Request which has been saved by the ASPSP (cf. § 4.5.3)

- The ASPSP has answered with a location link to the saved Payment/Transfer Request (cf. § 4.5.4)

- The TPP and the ASPSP have successfully processed a mutual check and authentication

- The TPP has presented its "OAUTH2 Client Credential" access token

Business flow

The PISP asks to retrieve the Payment/Transfer Request that has been saved by the ASPSP. The PISP uses the location link provided by the ASPSP in response of the posting of this request.The ASPSP returns the previously posted Payment/Transfer Request which is enriched with:

- The resource identifiers given by the ASPSP

- The status information of the Payment Request and of the subsequent credit transfer

Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| paymentRequestResourceId | string | true | Identification of the Payment Request Resource |

Returned value

Data type: HalPaymentRequest

Retrieval of the previously posted Payment Request

Exceptions

| Data type | Description |

|---|---|

| HttpException | Raised when ASPSP API responses with unspecified error. |

modifyPaymentRequest

Modification of a Payment/Transfer Request (PISP)

Description

The PISP sent a Payment/Transfer Request through a POST command.The ASPSP registered the Payment/Transfer Request, updated if necessary the relevant identifiers in order to avoid duplicates and returned the location of the updated Request.

The PISP got the Payment/Transfer Request that might have been updated with the resource identifiers, the status of the Payment/Transfer Request and the status of the subsequent credit transfer.

The PISP request for the payment cancellation or for some payment instructions cancellation

No other modification of the Payment/Transfer Request is allowed.

Prerequisites

- The TPP was registered by the Registration Authority for the PISP role

- The TPP was provided with an OAUTH2 "Client Credential" access token by the ASPSP (cf. § 3.4.3).

- The TPP previously posted a Payment/Transfer Request which was saved by the ASPSP (cf. § 4.5.3)

- The ASPSP answered with a location link to the saved Payment/Transfer Request (cf. § 4.5.4)

- The PISP retrieved the saved Payment/Transfer Request (cf. § 4.5.4)

- The TPP and the ASPSP successfully processed a mutual check and authentication

- The TPP presented its "OAUTH2 Client Credential" access token.

- The TPP presented the payment/transfer request.

- The PSU was successfully authenticated.

Business flow

the following cases can be applied:- Case of a payment with multiple instructions or a standing order, the PISP asks to cancel the whole Payment/Transfer or Standing Order Request including all non-executed payment instructions by setting the [paymentInformationStatus] to "RJCT" and the relevant [statusReasonInformation] to "DS02" at payment level.

- Case of a payment with multiple instructions, the PISP asks to cancel one or several payment instructions by setting the [transactionStatus] to "RJCT" and the relevant [statusReasonInformation] to "DS02" at each relevant instruction level.

- The specification of the authentication approaches that are supported by the PISP (any combination of "REDIRECT", "EMBEDDED" and "DECOUPLED" values).

- In case of possible REDIRECT or DECOUPLED authentication approach, one or two call-back URLs to be used by the ASPSP at the finalisation of the authentication and consent process :

- The first call-back URL will be called by the ASPSP if the Transfer Request is processed without any error or rejection by the PSU

- The second call-back URL is to be used by the ASPSP in case of processing error or rejection by the PSU. Since this second URL is optional, the PISP might not provide it. In this case, the ASPSP will use the same URL for any processing result.

- Both call-back URLS must be used in a TLS-secured request, including mutual authentication based on each party’s TLS certificate.

- In case of possible "EMBEDDED" or "DECOUPLED" approaches, a PSU identifier that can be processed by the ASPSP for PSU recognition.

- The specification of the chosen authentication approach taking into account both the PISP and the PSU capabilities.

- In case of chosen REDIRECT authentication approach, the URL to be used by the PISP for redirecting the PSU in order to perform an authentication.

Authentication flows for both use cases

Redirect authentication approach

When the chosen authentication approach within the ASPSP answers is set to "REDIRECT":- The PISP redirects the PSU to the ASPSP which authenticates the PSU

- The ASPSP asks the PSU to give (or deny) his/her consent to the Payment Request

- The PSU chooses or confirms which of his/her accounts shall be used by the ASPSP for the future Credit Transfer.

- The ASPSP is then able to initiate the subsequent Credit Transfer

- The ASPSP redirects the PSU to the PISP using one of the call-back URLs provided within the posted Payment Request

Decoupled authentication approach

When the chosen authentication approach is "DECOUPLED":- Based on the PSU identifier provided within the Payment Request by the PISP, the ASPSP gives the PSU with the Payment Request details and challenges the PSU for a Strong Customer Authentication on a decoupled device or application.

- The PSU chooses or confirms which of his/her accounts shall be used by the ASPSP for the future Credit Transfer.

- The ASPSP is then able to initiate the subsequent Credit Transfer

- The ASPSP notifies the PISP about the finalisation of the authentication and consent process by using one of the call-back URLs provided within the posted Payment Request

Embedded authentication approach

When the chosen authentication approach within the ASPSP answers is set to "EMBEDDED":- The TPP informs the PSU that a challenge is needed for completing the Payment Request processing. This challenge will be one of the following:

- A One-Time-Password sent by the ASPSP to the PSU on a separate device or application.

- A response computed by a specific device on base of a challenge sent by the ASPSP to the PSU on a separate device or application.

- The PSU unlock the device or application through a "knowledge factor" and/or an "inherence factor" (biometric), retrieves the Payment Request details and processes the data sent by the ASPSP;

- The PSU might choose or confirm which of his/her accounts shall be used by the ASPSP for the future Credit Transfer when the device or application allows it.

- When agreeing the Payment Request, the PSU enters the resulting authentication factor through the PISP interface which will forward it to the ASPSP through a confirmation request (cf. § 4.7)

Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| paymentRequestResourceId | string | true | Identification of the Payment Request Resource |

| paymentRequest | PaymentRequestResource | true | ISO20022 based payment Initiation Request |

Returned value

Data type: HalPaymentRequestCreation

The modification request has been saved. The ASPSP must authenticate the PSU before committing the update.

Exceptions

| Data type | Description |

|---|---|

| HttpException | Raised when ASPSP API responses with unspecified error. |

makePaymentRequestConfirmation

Confirmation of a payment request or a modification request (PISP)

Description

The PISP confirms one of the following requests- payment request on behalf of a merchant

- transfer request on behalf of the account's owner

- standing-order request on behalf of the account's owner

Prerequisites

- The TPP has been registered by the Registration Authority for the PISP role

- The TPP was provided with an OAUTH2 "Client Credential" access token by the ASPSP (cf. § 3.4.3).

- The TPP has previously posted a Request which has been saved by the ASPSP (cf. § 4.5.3)

- The ASPSP has answered with a location link to the saved Payment Request (cf. § 4.5.4)

- The TPP has retrieved the saved request in order to get the relevant resource Ids (cf. § 4.6).

- The TPP and the ASPSP have successfully processed a mutual check and authentication

- The TPP has presented its "OAUTH2 Client Credential" access token

Business flow

Once the PSU has been authenticated, it is the due to the PISP to confirm the Request to the ASPSP in order to complete the process flow.In REDIRECT and DECOUPLED approach, this confirmation is not a prerequisite to the execution of the Credit Transfer.

Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| paymentRequestResourceId | string | true | Identification of the Payment Request Resource |

| confirmation | PaymentRequestConfirmation | false | Data needed for confirmation of the Payment Request, especially in EMBEDDED approach |

Detailed descriptions

confirmation: Data needed for confirmation of the Payment Request, especially in EMBEDDED approach

Returned value

Data type: HalPaymentRequest

retrieval of the Payment Request enriched with the status report

Exceptions

| Data type | Description |

|---|---|

| HttpException | Raised when ASPSP API responses with unspecified error. |

Data types

Auth

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

url |

string |

false |

URL for authorization |

Token

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

access_token |

string |

false |

The access token value |

|

token_type |

string |

false |

Type of the token is set to "Bearer" |

|

expires_in |

integer(int32) |

false |

The lifetime in seconds of the access token |

|

refresh_token |

string |

false |

The refresh token value |

|

scope |

string |

false |

Scopes of the token |

Enumerated Values

token_type

| Value | Description |

|---|---|

|

Bearer |

— |

HalConnectors

HYPERMEDIA structure used for returning the list of the connectors for given countries

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

connectors |

true |

List of connectors |

|

|

_links |

false |

links that can be used for further navigation when browsing connector information |

ConnectorsLinks

links that can be used for further navigation when browsing connector information

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

self |

true |

hypertext reference |

Connector

Information about connector used for interaction with a bank

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

name |

string |

false |

The name of connector |

|

countries |

[string] |

false |

The list of all countries supported by connector |

|

scopes |

[string] |

false |

The list of all scopes supported by connector |

AuthenticationApproach

The ASPSP, based on the authentication approaches proposed by the PISP, choose the one that it can processed, in respect with the preferences and constraints of the PSU and indicates in this field which approach has been chosen

Base type

string

Enumerated Values

| Value | Description |

|---|---|

|

REDIRECT |

the PSU is redirected by the TPP to the ASPSP which processes identification and authentication |

|

DECOUPLED |

the TPP identifies the PSU and forwards the identification to the ASPSP which processes the authentication through a decoupled device |

|

EMBEDDED |

the TPP identifies the PSU and forwards the identification to the ASPSP which starts the authentication. The TPP forwards one authentication factor of the PSU (e.g. OTP or response to a challenge) |

GenericIdentification

ISO20022: Unique identification of an account, a person or an organisation, as assigned by an issuer. API: The ASPSP will document which account reference type it will support.

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

identification |

string |

true |

API Identifier |

|

schemeName |

string |

true |

Name of the identification scheme. Partially based on ISO20022 external code list |

|

issuer |

string |

false |

ISO20022: Entity that assigns the identification. this could a country code or any organisation name or identifier that can be recognized by both parties |

Enumerated Values

schemeName

| Value | Description |

|---|---|

|

BANK |

BankPartyIdentification. Unique and unambiguous assignment made by a specific bank or similar financial institution to identify a relationship as defined between the bank and its client. |

|

COID |

CountryIdentificationCode. Country authority given organisation identification (e.g., corporate registration number) |

|

SREN |

The SIREN number is a 9 digit code assigned by INSEE, the French National Institute for Statistics and Economic Studies, to identify an organisation in France. |

|

SRET |

The SIRET number is a 14 digit code assigned by INSEE, the French National Institute for Statistics and Economic Studies, to identify an organisation unit in France. It consists of the SIREN number, followed by a five digit classification number, to identify the local geographical unit of that entity. |

|

NIDN |

NationalIdentityNumber. Number assigned by an authority to identify the national identity number of a person. |

|

OAUT |

OAUTH2 access token that is owned by the PISP being also an AISP and that can be used in order to identify the PSU |

|

CPAN |

Card PAN |

|

BBAN |

Basic Bank Account Number. Represents a country-specific bank account number. |

AccountIdentification

Unique and unambiguous identification for the account between the account owner and the account servicer.

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

iban |

string |

false |

ISO20022: International Bank Account Number (IBAN) - identification used internationally by financial institutions to uniquely identify the account of a customer. Further specifications of the format and content of the IBAN can be found in the standard ISO 13616 "Banking and related financial services - International Bank Account Number (IBAN)" version 1997-10-01, or later revisions. |

|

other |

false |

ISO20022: Unique identification of an account, a person or an organisation, as assigned by an issuer. |

AmountType

ISO20022: structure aiming to carry either an instructed amount or equivalent amount. Both structures embed the amount and the currency to be used.

API: only instructed amount can be used

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

currency |

string |

true |

Specifies the currency of the amount. A code allocated to a currency by a Maintenance Agency under an international identification scheme, as described in the latest edition of the international standard ISO 4217 "Codes for the representation of currencies and funds". |

|

amount |

string(number) |

true |

ISO20022: Amount of money to be moved between the debtor and creditor, before deduction of charges, expressed in the currency as ordered by the initiating party. |

BankTransactionCode

ISO20022: Allows the account servicer to correctly report a transaction, which in its turn will help account owners to perform their cash management and reconciliation operations.

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

code |

string |

false |

ISO20022: Specifies the family of a transaction within the domain |

|

subCode |

string |

false |

ISO20022: Specifies the sub-product family of a transaction within a specific family |

ClearingSystemMemberIdentification

ISO20022: Information used to identify a member within a clearing system. API: to be used for some specific international credit transfers in order to identify the beneficiary bank

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

clearingSystemId |

string |

false |

ISO20022: Specification of a pre-agreed offering between clearing agents or the channel through which the payment instruction is processed. |

|

memberId |

string |

false |

ISO20022: Identification of a member of a clearing system. |

FinancialInstitutionIdentification

ISO20022: Unique and unambiguous identification of a financial institution, as assigned under an internationally recognised or proprietary identification scheme.

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

bicFi |

string |

true |

ISO20022: Code allocated to a financial institution by the ISO 9362 Registration Authority as described in ISO 9362 "Banking - Banking telecommunication messages - Business identification code (BIC)". |

|

clearingSystemMemberId |

false |

ISO20022: Information used to identify a member within a clearing system. |

|

|

name |

string |

false |

Name of the financial institution |

|

postalAddress |

false |

ISO20022 : Information that locates and identifies a specific address, as defined by postal services. |

PostalAddress

ISO20022 : Information that locates and identifies a specific address, as defined by postal services.

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

country |

string |

true |

ISO20022: Country in which a person resides (the place of a person's home). In the case of a company, it is the country from which the affairs of that company are directed. |

|

addressLine |

[string] |

true |

Unstructured address. The two lines must embed zip code and town name |

PartyIdentification

API : Description of a Party which can be either a person or an organization.

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

name |

string |

true |

ISO20022: Name by which a party is known and which is usually used to identify that party. |

|

postalAddress |

false |

ISO20022 : Information that locates and identifies a specific address, as defined by postal services. |

|

|

organisationId |

false |

Unique and unambiguous way to identify an organisation. |

|

|

privateId |

false |

Unique and unambiguous identification of a person. |

ResourceId

Identifier assigned by the ASPSP for further use of the created resource through API calls

Base type

string

PaymentIdentification

ISO20022: Set of elements used to reference a payment instruction.

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

resourceId |

false |

Identifier assigned by the ASPSP for further use of the created resource through API calls |

|

|

instructionId |

string |

false |

ISO20022: Unique identification as assigned by an instructing party for an instructed party to unambiguously identify the instruction. API: Unique identification shared between the PISP and the ASPSP |

|

endToEndId |

string |

false |

ISO20022: Unique identification assigned by the initiating party to unambiguously identify the transaction. This identification is passed on, unchanged, throughout the entire end-to-end chain. API: Unique identification shared between the merchant and the PSU |

PriorityCode

ISO20022: Indicator of the urgency or order of importance that the instructing party would like the instructed party to apply to the processing of the instruction.

Base type

string

Enumerated Values

| Value | Description |

|---|---|

|

HIGH |

High priority |

|

NORM |

Normal priority |

CategoryPurposeCode

ISO20022: Specifies the high level purpose of the instruction based on a set of pre-defined categories. This is used by the initiating party to provide information concerning the processing of the payment. It is likely to trigger special processing by any of the agents involved in the payment chain.

Base type

string

Enumerated Values

| Value | Description |

|---|---|

|

CASH |

Transaction is a general cash management instruction (CashManagementTransfer). |

|

DVPM |

Code used to pre-advise the account servicer of a forthcoming deliver against payment instruction (DeliverAgainstPayment). |

ServiceLevelCode

ISO20022: Agreement under which or rules under which the transaction should be processed. Specifies a pre-agreed service or level of service between the parties, as published in an external service level code list.

Base type

string

Enumerated Values

| Value | Description |

|---|---|

|

NURG |

Other Credit Transfer |

|

SEPA |

SEPA Credit Transfer |

LocalInstrumentCode

ISO20022: User community specific instrument. Usage: This element is used to specify a local instrument, local clearing option and/or further qualify the service or service level.

Base type

string

PaymentTypeInformation

ISO20022: Set of elements used to further specify the type of transaction.

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

instructionPriority |

false |

ISO20022: Indicator of the urgency or order of importance that the instructing party would like the instructed party to apply to the processing of the instruction. |

|

|

serviceLevel |

false |

ISO20022: Agreement under which or rules under which the transaction should be processed. Specifies a pre-agreed service or level of service between the parties, as published in an external service level code list. |

|

|

localInstrument |

false |

ISO20022: User community specific instrument. |

|

|

categoryPurpose |

false |

ISO20022: Specifies the high level purpose of the instruction based on a set of pre-defined categories. This is used by the initiating party to provide information concerning the processing of the payment. It is likely to trigger special processing by any of the agents involved in the payment chain. |

PurposeCode

ISO20022: Underlying reason for the payment transaction, as published in an external purpose code list.

Base type

string

Enumerated Values

| Value | Description |

|---|---|

|

ACCT |

Funds moved between 2 accounts of same account holder at the same bank. |

|

CASH |

general cash management instruction, may be used for Transfer Initiation. |

|

COMC |

Transaction is related to a payment of commercial credit or debit. |

|

CPKC |

General Carpark Charges Transaction is related to carpark charges. |

|

TRPT |

Transport RoadPricing Transaction is for the payment to top-up pre-paid card and electronic road pricing for the purpose of transportation. |

ChargeBearerCode

ISO20022: Specifies which party/parties will bear the charges associated with the processing of the payment transaction.

Base type

string

Enumerated Values

| Value | Description |

|---|---|

|

SLEV |

Service level. Charges are to be applied following the rules agreed in the service level and/or scheme. |

|

SHAR |

Shared. |

UnstructuredRemittanceInformation

ISO20022: Information supplied to enable the matching of an entry with the items that the transfer is intended to settle, such as commercial invoices in an accounts' receivable system. API: Only one occurrence is allowed

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

remittanceLine |

string |

false |

Relevant information to the transaction |

PaymentInformationStatusCode

ISO20022: Specifies the status of the payment information.

Base type

string

Enumerated Values

| Value | Description |

|---|---|

|

ACCP |

AcceptedCustomerProfile. Preceding check of technical validation was successful. Customer profile check was also successful. |

|

ACSC |

AcceptedSettlementCompleted. Settlement on the debtor's account has been completed. |

|

ACSP |

AcceptedSettlementInProcess. All preceding checks such as technical validation and customer profile were successful. Dynamic risk assessment is now also successful and therefore the Payment Request has been accepted for execution. |

|

ACTC |

AcceptedTechnicalValidation. Authentication and syntactical and semantical validation are successful. |

|

ACWC |

AcceptedWithChange. Instruction is accepted but a change will be made, such as date or remittance not sent. |

|

ACWP |

AcceptedWithoutPosting. Payment instruction included in the credit transfer is accepted without being posted to the creditor customer’s account. |

|

PART |

PartiallyAccepted. A number of transactions have been accepted, whereas another number of transactions have not yet achieved 'accepted' status. |

|

RCVD |

Received. Payment initiation has been received by the receiving agent. |

|

PDNG |

Pending. Payment request or individual transaction included in the Payment Request is pending. Further checks and status update will be performed. |

|

RJCT |

Rejected. Payment request has been rejected. |

TransactionIndividualStatusCode

ISO20022: Specifies the status of the payment information group.

Base type

string

Enumerated Values

| Value | Description |

|---|---|

|

RCVD |

Payment request or individual transaction included in the Payment Request has been received by the receiving agent. |

|

RJCT |

Payment request or individual transaction included in the Payment Request has been rejected. |

|

PDNG |

Pending. Payment request or individual transaction included in the Payment Request is pending. Further checks and status update will be performed. |

|

ACSP |

All preceding checks such as technical validation and customer profile were successful and therefore the Payment Request has been accepted for execution. |

|

ACSC |

Settlement on the debtor's account has been completed. |

StatusReasonInformation

ISO20022: Provides detailed information on the status reason. Can only be used in status equal to "RJCT".

Base type

string

Enumerated Values

| Value | Description |

|---|---|

|

AC01 |

IncorectAccountNumber. the account number is either invalid or does not exist |

|

AC04 |

ClosedAccountNumber. the account is closed and cannot be used |

|

AC06 |

BlockedAccount. the account is blocked and cannot be used |

|

AG01 |

Transaction forbidden. Transaction forbidden on this type of account |

|

CH03 |

RequestedExecutionDateOrRequestedCollectionDateTooFarInFuture. The requested execution date is too far in the future |

|

CUST |

RequestedByCustomer. The reject is due to the debtor (refusal or lack of liquidity) |

|

DS02 |

OrderCancelled. An authorized user has cancelled the order |

|

FF01 |

InvalidFileFormat. The reject is due to the original Payment Request which is invalid (syntax, structure or values) |

|

FRAD |

FraudulentOriginated. the Payment Request is considered as fraudulent |

|

MS03 |

NotSpecifiedReasonAgentGenerated. No reason specified by the ASPSP |

|

NOAS |

NoAnswerFromCustomer. The PSU has neither accepted nor rejected the Payment Request and a time-out has occurred |

|

RR01 |

MissingDebtorAccountOrIdentification. The Debtor account and/or Identification are missing or inconsistent |

|

RR03 |

MissingCreditorNameOrAddress. Specification of the creditor’s name and/or address needed for regulatory requirements is insufficient or missing. |

|

RR04 |

RegulatoryReason. Reject from regulatory reason |

|

RR12 |

InvalidPartyID. Invalid or missing identification required within a particular country or payment type. |

RegulatoryReportingCode

Information needed due to regulatory and statutory requirements. Economical codes to be used are provided by the National Competent Authority

Base type

string

RegulatoryReportingCodes

List of needed regulatory reporting codes for international payments

Base type

RequestedExecutionDate

ISO20022: Date at which the initiating party requests the clearing agent to process the payment. API: This date can be used in the following cases:

- the single requested execution date for a payment having several instructions. In this case, this field must be set at the payment level.

- the requested execution date for a given instruction within a payment. In this case, this field must be set at each instruction level.

- The first date of execution for a standing order. When the payment cannot be processed at this date, the ASPSP is allowed to shift the applied execution date to the next possible execution date for non-standing orders. For standing orders, the [executionRule] parameter helps to compute the execution date to be applied.

Base type

string(date-time)

EndDate

The last applicable day of execution for a given standing order. If not given, the standing order is considered as endless.

Base type

string(date-time)

ExecutionRule

Execution date shifting rule for standing orders This data attribute defines the behaviour when recurring payment dates falls on a weekend or bank holiday. The payment is then executed either the "preceding" or "following" working day. ASPSP might reject the request due to the communicated value, if rules in Online-Banking are not supporting this execution rule.

Base type

string

Enumerated Values

| Value | Description |

|---|---|

|

FWNG |

following |

|

PREC |

preceding |

FrequencyCode

Frequency rule for standing orders. The following codes from the "EventFrequency7Code" of ISO 20022 are supported. However, each ASPSP might restrict these values into a subset.

Base type

string

Enumerated Values

| Value | Description |

|---|---|

|

DAIL |

Daily |

|

WEEK |

Weekly |

|

TOWK |

EveryTwoWeeks |

|

MNTH |

Monthly |

|

TOMN |

EveryTwoMonths |

|

QUTR |

Quarterly |

|

SEMI |

SemiAnnual |

|

YEAR |

Annual |

CreditTransferTransaction

ISO20022: Payment processes required to transfer cash from the debtor to the creditor. API:

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

paymentId |

false |

ISO20022: Set of elements used to reference a payment instruction. |

|

|

requestedExecutionDate |

false |

ISO20022: Date at which the initiating party requests the clearing agent to process the payment. |

|

|

endDate |

false |

The last applicable day of execution for a given standing order. |

|

|

executionRule |

false |

Execution date shifting rule for standing orders |

|

|

frequency |

false |

Frequency rule for standing orders. |

|

|

instructedAmount |

true |

ISO20022: structure aiming to carry either an instructed amount or equivalent amount. Both structures embed the amount and the currency to be used. |

|

|

beneficiary |

true |

Specification of a beneficiary |

|

|

ultimateCreditor |

false |

API : Description of a Party which can be either a person or an organization. |

|

|

regulatoryReportingCodes |

false |

List of needed regulatory reporting codes for international payments |

|

|

remittanceInformation |

false |

ISO20022: Information supplied to enable the matching of an entry with the items that the transfer is intended to settle, such as commercial invoices in an accounts' receivable system. |

|

|

transactionStatus |

false |

ISO20022: Specifies the status of the payment information group. |

|

|

statusReasonInformation |

false |

ISO20022: Provides detailed information on the status reason. Can only be used in status equal to "RJCT". |

BalanceStatus

Type of balance

Base type

string

Enumerated Values

| Value | Description |

|---|---|

|

CLBD |

(ISO20022 ClosingBooked) Accounting Balance |

|

FWAV |

(ISO20022 ForwardAvailable) Balance of money that is at the disposal of the account owner on the date specified |

|

ITAV |

(ISO20022 InterimAvailable) Available balance calculated in the course of the day |

|

ITBD |

(ISO20022 InterimBooked) Booked balance calculated in the course of the day |

|

OTHR |

Other Balance |

|

VALU |

Value-date balance |

|

XPCD |

(ISO20022 Expected) Instant Balance |

TransactionStatus

Type of Transaction

Base type

string

Enumerated Values

| Value | Description |

|---|---|

|

BOOK |

(ISO20022 ClosingBooked) Accounted transaction |

|

CNCL |

Cancelled transaction |

|

HOLD |

Account hold |

|

OTHR |

Transaction with unknown status or not fitting the other options |

|

PDNG |

(ISO20022 Expected) Instant Balance Transaction |

|

RJCT |

Rejected transaction |

|

SCHD |

Scheduled transaction |

Transaction

structure of a transaction

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

resourceId |

false |

Identifier assigned by the ASPSP for further use of the created resource through API calls |

|

|

entryReference |

string |

false |

Technical incremental identification of the transaction. |

|

transactionAmount |

true |

ISO20022: structure aiming to carry either an instructed amount or equivalent amount. Both structures embed the amount and the currency to be used. |

|

|

creditor |

false |

API : Description of a Party which can be either a person or an organization. |

|

|

debtor |

false |

API : Description of a Party which can be either a person or an organization. |

|

|

bankTransactionCode |

false |

ISO20022: Allows the account servicer to correctly report a transaction, which in its turn will help account owners to perform their cash management and reconciliation operations. |

|

|

creditDebitIndicator |

string |

true |

Accounting flow of the transaction |

|

status |

true |

Type of Transaction |

|

|

bookingDate |

string(date) |

false |

Booking date of the transaction on the account |

|

valueDate |

string(date) |

false |

Value date of the transaction on the account |

|

transactionDate |

string(date) |

false |

Date used for specific purposes:

|

|

remittanceInformation |

false |

ISO20022: Information supplied to enable the matching of an entry with the items that the transfer is intended to settle, such as commercial invoices in an accounts' receivable system. |

Enumerated Values

creditDebitIndicator

| Value | Description |

|---|---|

|

CRDT |

Credit type transaction |

|

DBIT |

Debit type transaction |

AccountResource

PSU account that is made available to the TPP

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

resourceId |

false |

Identifier assigned by the ASPSP for further use of the created resource through API calls |

|

|

bicFi |

string |

false |

ISO20022: Code allocated to a financial institution by the ISO 9362 Registration Authority as described in ISO 9362 "Banking - Banking telecommunication messages - Business identification code (BIC)". |

|

accountId |

false |

Unique and unambiguous identification for the account between the account owner and the account servicer. |

|

|

name |

string |

true |

Label of the PSU account In case of a delayed debit card transaction set, the name shall specify the holder name and the imputation date |

|

details |

string |

false |

Specifications that might be provided by the ASPSP