Introduction

Welcome to the documentation of Enable Banking aggregation core!

This documentation focuses on the low-level interface of the core technology for aggregation of Open Banking APIs.

Get started by cloning our sample repository

$ git clone https://github.com/enablebanking/OpenBankingJavaExamples

$ git clone https://github.com/enablebanking/OpenBankingJSExamples

$ git clone https://github.com/enablebanking/OpenBankingPythonExamples

Enable Banking aggregation core provides native Java, Javascript and Python libraries for connecting directly from your code to a number of Open Banking APIs without intermediate aggregation services. The libraries provide unified interface for interacting with multiple ASPSPs (i.e. banks and similar financial institutions), harmonize data and implement all cryptographic functionality needed for interaction with PSD2 APIs, such as mTLS connection using eIDAS QWAC and request signing using eIDAS QSeal certificate.

The aggregation core powers Enable Banking API and its on-premise version.

It's the easiest to get started with the aggregation core by using our code samples. The complete code samples for Java, Javascript and Python are available under our Github account: https://github.com/enablebanking.

User guide

Authorization and user token refresh

This section describes a basic authorization flow and access token refreshing flow (if it is supported by an ASPSP).

In order to execute this flow correctly for a specific ASPSP connector, one should obtain connector's meta information and build your flow according to that information.

Below is the basic example of how such flow can be implemented.

0. Import library and choose connector

import com.enablebanking.ApiClient;

import com.enablebanking.api.AuthApi;

import com.enablebanking.api.MetaApi;

import com.enablebanking.model.*;

// Initializing meta interface.

MetaApi metaApi = new MetaApi(new ApiClient());

// Getting connectors for a country.

HalConnectors connectors = metaApi.getConnectors("FI");

// Finding meta data for a desired connector

Connector connectorMeta = null;

for (Connector conn : connectors.getConnectors()) {

if (conn.getName().equals('Sample')) {

connectorMeta = conn;

break;

}

}

const enablebanking = require('enablebanking');

// Initializing meta interface.

const metaApi = new enablebanking.MetaApi(new enablebanking.ApiClient());

// Getting connectors for a country.

const connectors = await metaApi.getConnectors({country: 'FI'});

// Finding meta data for a desired connector

let connectorMeta;

for (const conn of connectors.connectors) {

if (conn.name == 'Sample') {

connectorMeta = conn;

break;

}

}

import enablebanking

// Initializing meta interface.

meta_api = enablebanking.MetaApi(enablebanking.ApiClient())

// Getting connectors for a country.

connectors_info = meta_api.get_connectors(country='FI')

// Finding meta data for a desired connector

connector_meta = None

for conn in .connectors:

if conn.name == 'Sample':

connector_meta = conn

break

First of all we are getting the list of connectors for a country and choosing one connector, which we are going to used. In real-world case a list of ASPSPs accessed with the connectors, shall be shown to a user for making a choise. In the code sample we are just using 'Sample'.

1. Initialize API client and authentication interface

// Initializing settings; connector settings class to be replaced with a real one.

ConnectorSettings settings = new SampleConnectorSettings()

// other settings, including callback redirect URI, to be set here

.sandbox(true);

// Creating client instance.

ApiClient apiClient = new ApiClient(settings);

// Initializing authentication interface.

AuthApi authApi = new AuthApi(apiClient);

// Creating client instance; connector name to be replaced with a real one.

const apiClient = new enablebanking.ApiClient('Sample', {

sandbox: true,

/* other settings, including callback redirect URI, to be set here */

});

// Initializing authentication interface.

const authApi = new enablebanking.AuthApi(apiClient);

// Creating client instance; connector name to be replaced with a real one.

api_client = enablebanking.ApiClient(

"Sample",

{

"sandbox": True,

# other settings, including callback redirect URI, to be set here

})

// Initializing authentication interface.

auth_api = enablebanking.AuthApi(api_client)

After the choise has been made, we need to initialize API client for the chosen connector and create the authentication interface.

Connector settings (i.e. set of parameters used when initializing API client) differ from one connector to another. Description of settings for every connector can be found here.

2. Initiate user authentication

// Checking if user ID is required when initiating user authentication.

String userId = null;

if (connectorMeta.getAuthInfo().get(0).getInfo().isUserIdRequired()) {

// Setting userId; in real case it is coming from a user.

userId = "someUserId";

}

// Checking if user consent can be received while user authentication.

Access access = null;

if (connectorMeta.getAuthInfo().get(0).getInfo().isAccess()) {

// Initializing access, i.e. scope of access, which user needs to consent with.

access = new Access(/* user consent parameters */);

}

// Initiating user authentication

Auth auth = authApi.getAuth(

"test", // state returned to callback redirect URI

userId,

access);

// Sending user to this URL for authentication

String authUrl = auth.url;

// Checking if user ID is required when initiating user authentication.

let userId;

if (connectorMeta.authInfo[0].info.userIdRequired) {

// Setting userId; in real case it is coming from a user.

userId = "someUserId";

}

// Checking if user consent can be received while user authentication.

let access;

if (connectorMeta.authInfo[0].info.access) {

// Initializing access, i.e. scope of access, which user needs to consent with.

access = new Access(/* user consent parameters */);

}

// Initiating user authentication

const auth = await authApi.getAuth({

state: 'test', // state returned to callback redirect URI

access: access,

userId: userId

});

// Sending user to this URL for authentication

const authUrl = auth.url;

# Checking if user ID is required when initiating user authentication.

user_id = None

if connector_meta.auth_info[0].info.user_id_required:

# Setting userId; in real case it is coming from a user.

user_id = "some_user_id"

# Checking if user consent can be received while user authentication.

access = None

if connector_meta.auth_info[0].info.access:

# Initializing access, i.e. scope of access, which user needs to consent with.

access = enablebanking.Access(

# user consent parameters

)

# Initiating user authentication

auth = auth_api.get_auth(

state='test', # state returned to callback redirect URI

user_id=user_id,

access=access)

# Sending user to this URL for authentication

url = auth.url

Some connectors require user ID to be set when initiating user authentication. This information is available in connector meta and user ID shall be requested from a user.

Also scope of access, which user needs to consent with, shall be set. It will be used if user consent can be received while user authentication. If not, modify consents shall be used later on. By default widest possible scope will be requested.

And after the parameters are set, user authentication shall be initiated.

3. Obtain authorization code and get an access token

// Extracting data from the URL where user was redirected to after authentication.

AuthRedirect redirectInfo = authApi.parseRedirectUrl("https://your.domain/callback");

// Obtaining user access token (and possibly refresh token as well).

Token token = authApi.makeToken(

"authorization_code", // grant type

redirectInfo.code, // authorization code

auth.env // authentication environment

);

// Extracting data from the URL where user was redirected to after authentication.

AuthRedirect redirectInfo = authApi.parseRedirectUrl('https://your.domain/callback');

// Obtaining user access token (and possibly refresh token as well).

const token = await authApi.makeToken(

'authorization_code', // grant type

redirectInfo.code, // authorization code

auth.env // authentication environment

)

# Extracting data from the URL where user was redirected to after authentication.

redirect_info = auth_api.parse_redirect_url("https://your.domain/callback")

# Obtaining user access token (and possibly refresh token as well).

token = auth_api.make_token(

"authorization_code", # grant type

code, # authorization code

auth.env)

After the user has authenticated (and is redirected back to the desired URL), we are parsing this callback redirect URL to obtain an authorization code and other data.

The authorization code is to be used when making user access token. Along with the access token, returned Token data structure contains lifetime of the access token in seconds and refresh token (if it is supported).

4. Refresh access token (when needed)

Token refreshedToken = null;

if (connectorMeta.isRefreshToken()) {

refreshedToken = authApi.makeToken(

"refresh_token", // grant type

token.getRefreshToken(), // refresh token

null // environment is not needed for token refresh

);

}

let refreshedToken;

if (connectorMeta.refreshToken) {

refreshedToken = authApi.makeToken(

"refresh_token", // grant type

token.refresh_token // refresh token

);

}

refreshed_token = None

if connector_meta.refresh_token:

refreshed_token = auth_api.make_token(

"refresh_token",

token.refresh_token

)

When supported, refresh token can be used for obtaining new user access token.

Information on whether refresh tokens are supported by a connector can be seen in the connector meta.

Reference

Select a language for code samples from the tabs above or the mobile navigation menu.

Enable Banking aggregation core consists of 4 interfaces:

- Meta provides information about available connectors;

- Auth provides PSU (bank user) authentication and token creation functionality;

- AISP provides functions for accessing account information, such as transactions and balances, on behalf of a PSU;

- PISP provides functions for initiating and conforming payment requests.

The same calls and data structures are used for interacting with different ASPSPs. In order to use each of the interfaces corresponding instance needs to be created. When instantiating any of the interfaces except Meta, ASPSP connector name and settings need to be supplied. The settings differ from one connector to another (although many of them have the same properties) and are described in the Connectors section of the documentation.

Enable Banking aggregation core interfaces were originally based on STET PSD2 specification, but have been heavily modified and extended in order to support usage scenarious beyond the original specification.

License: LicenseRef-LICENSE

Meta API

getConnectors

Code samples

const enablebanking = require('enablebanking');

const metaApi = new enablebanking.MetaApi(new enablebanking.ApiClient());

const connectors = await metaApi.getConnectors({

country: 'FI' // requesting connectors for Finland

});

import enablebanking

meta_api = enablebanking.MetaApi(enablebanking.ApiClient())

connectors = meta_api.get_connectors(

country='FI') # requesting connectors for Finland

import com.enablebanking.*;

import com.enablebanking.model.*;

import com.enablebanking.api.MetaApi;

MetaApi metaApi = new MetaApi(new ApiClient());

HalConnectors connectors = metaApi.getConnectors("FI"); // connectors for Finland

Retrieval of the available connectors

Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| country | string | false | Country ISO 3166-1 alpha-2 code |

| connector | string | false | Connector name |

Returned value

Data type: HalConnectors

List of connectors

Auth API

getAuth

Code samples

const enablebanking = require('enablebanking');

const authApi = new enablebanking.AuthApi(

new enablebanking.ApiClient('ConnectorName', { /* Connector settings */ }));

const { url } = await authApi.getAuth(

{

state: 'test' // state to pass to redirect URL

});

import enablebanking

auth_api = enablebanking.AuthApi(enablebanking.ApiClient(

'ConnectorName',

{

# Connector settings

})

url = auth_api.get_auth(

state='test', # state to pass to redirect URL

).url

import com.enablebanking.ApiClient;

import com.enablebanking.model.*;

import com.enablebanking.api.AuthApi;

// To be replaced with real connector settings class and set properties

ConnectorSettings connectorSettings = new SomeBankConnectorSettings();

AuthApi authApi = new AuthApi(new ApiClient(connectorSettings));

String url = authApi.getAuth(

"test", // state to pass to redirect URL

null, // user id

null, // password

null // not passing access request (bank's defaults will be used)

).url;

Request Authorization Data

Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| state | string | false | Arbitrary String to be returned from to redirect URI |

| credentials | array[string] | false | Array of user credentials which are required to log in to the bank (e.g. user ID, password, phone number etc) |

| method | string | false | Authentication method |

| access | Access | false | Request for access to account information |

Detailed descriptions

access: Request for access to account information This parameter should be set to override defaults for the banks, which allow PSUs to give consent for account information sharing right after authentication.

Returned value

Data type: Auth

Authorization Data

Exceptions

| Data type | Description |

|---|---|

| HttpException | Raised when ASPSP API responses with unspecified error. |

makeToken

Code samples

const enablebanking = require('enablebanking');

const authApi = new enablebanking.AuthApi(

new enablebanking.ApiClient('ConnectorName', { /* Connector settings */ }));

const token = await authApi.makeToken(

'authorization_code', // grant type, MUST be set to "authorization_code"

'so43ls-3ldg03sd-hl4saa3l2sl5czfhl3'); // The code received in the query string when redirected from authorization

import enablebanking

auth_api = enablebanking.AuthApi(enablebanking.ApiClient(

'ConnectorName',

{

# Connector settings

})

token = auth_api.make_token(

'authorization_code', # grant type, MUST be set to "authorization_code"

'so43ls-3ldg03sd-hl4saa3l2sl5czfhl3') # The code received in the query string when redirected from authorization

import com.enablebanking.ApiClient;

import com.enablebanking.model.*;

import com.enablebanking.api.AuthApi;

// To be replaced with real connector settings class and set properties

ConnectorSettings connectorSettings = new SomeBankConnectorSettings();

AuthApi authApi = new AuthApi(new ApiClient(connectorSettings));

Token token = authApi.makeToken(

"authorization_code", // grant type, MUST be set to "authorization_code"

"so43ls-3ldg03sd-hl4saa3l2sl5czfhl3" // The code received in the query string when redirected from authorization

);

Request Access Token

Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| grant_type | string | true | Value should be set to authorization_code or refresh_token depending on what |

| code | string | false | Value of either the code received in the query string when redirected from |

| auth_env | string | false | Additional environment data for makeToken. This parameter is only required for some connectors. |

Detailed descriptions

grant_type: Value should be set to authorization_code or refresh_token depending on what

passed to code parameter.

code: Value of either the code received in the query string when redirected from authorization page or the refresh token used for renewing access token.

Enumerated Values

grant_type

| Value | Description |

|---|---|

| authorization_code | Used to exchange an authorization code for an access token. After the user returns to the client via the redirect URL, the application will get the authorization code from the URL and use it to request an access token. |

| refresh_token | Used to exchange a refresh token for an access token when the access token has expired. This allows clients to continue to have a valid access token without further interaction with the user. Please note that refresh token is likely to be changed when calling `makeToken` with `refresh_token` grant type. |

Returned value

Data type: Token

Authorisation token (Bearer)

Exceptions

| Data type | Description |

|---|---|

| HttpException | Raised when ASPSP API responses with unspecified error. |

getCurrentToken

Code samples

const enablebanking = require('enablebanking');

const authApi = new enablebanking.AuthApi(

new enablebanking.ApiClient('ConnectorName', { /* Connector settings */ }));

const token = await authApi.getCurrentToken();

import enablebanking

auth_api = enablebanking.AuthApi(enablebanking.ApiClient(

'ConnectorName',

{

# Connector settings

})

token = auth_api.get_current_token()

import com.enablebanking.ApiClient;

import com.enablebanking.model.*;

import com.enablebanking.api.AuthApi;

// To be replaced with real connector settings class and set properties

ConnectorSettings connectorSettings = new SomeBankConnectorSettings();

AuthApi authApi = new AuthApi(new ApiClient(connectorSettings));

Token token = authApi.getCurrentToken();

Get current token data

Returned value

Data type: Token

Current token. Values for some fields might be missing if not used.

parseRedirectUrl

Parsing of redirect url during authorization

Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| redirectUrl | string | true | Redirect url |

Returned value

Data type: AuthRedirect

Structured data extracted from redirect URL

validateCredentials

Parsing of redirect url during authorization

Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| credentials | array[string] | false | Array of user credentials which are required to log in to the bank (e.g. user ID, password, phone number etc) |

| method | string | false | Authentication method |

Returned value

Data type: AuthRedirect

Structured data extracted from redirect URL

setClientInfo

Set extra PSU headers

Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| clientInfo | ClientInfo | false | ClientInfo object with PSU headers |

Returned value

Data type: None

Client Info was successfully set.

AISP API

getAccounts

Code samples

const enablebanking = require('enablebanking');

const aispApi = new enablebanking.AISPApi(

new enablebanking.ApiClient('ConnectorName', { /* Connector settings */ }));

const accounts = await aispApi.getAccounts();

import enablebanking

aisp_api = enablebanking.AISPApi(enablebanking.ApiClient(

'ConnectorName',

{

# Connector settings

}))

accounts = aisp_api.get_accounts()

import com.enablebanking.ApiClient;

import com.enablebanking.api.AispApi;

import com.enablebanking.model.*;

// To be replaced with real connector settings class and set properties

ConnectorSettings connectorSettings = new SomeBankConnectorSettings();

AispApi aispApi = new AispApi(new ApiClient(connectorSettings));

HalAccounts accounts = aispApi.getAccounts();

Retrieval of the PSU accounts (AISP)

Description

This call returns all payment accounts that are relevant the PSU on behalf of whom the AISP is connected.Prerequisites

- Valid PSU access token shall be set in the connector.

- For ASPSPs requiring PSU consent for listing the accounts, consent ID shall be set in the connector.

Business flow

The TPP sends a request to the ASPSP for retrieving the list of the PSU payment accounts. The ASPSP computes the relevant PSU accounts and builds the answer as an accounts list. Each payment account will be provided with its characteristics returned by ASPSP, which may vary between ASPSPs and depending on the consent given by the PSU.Returned value

Data type: HalAccounts

Returned value consists of the list of the accounts that have been made available to the AISP by the PSU.

Exceptions

| Data type | Description |

|---|---|

| HttpException | Raised when ASPSP API responses with unspecified error. |

| DataRetrievalException | Raised when unable to retrieve data requested from ASPSP API. |

| InsufficientScopeException | Raised when consent given by the PSU does not allow to retrieve requested data. |

| AccountNotAccessibleException | Raised when non accessible or inexsitent account transactions are requested. |

| InvalidResponseSignatureException | none |

getAccountBalances

Code samples

const enablebanking = require('enablebanking');

const aispApi = new enablebanking.AISPApi(

new enablebanking.ApiClient('ConnectorName', { /* Connector settings */ }));

const balances = await aispApi.getAccountBalances('203059694928560295396833');

import enablebanking

aisp_api = enablebanking.AISPApi(enablebanking.ApiClient(

'ConnectorName',

{

# Connector settings

}))

balances = aisp_api.get_account_balances('203059694928560295396833')

import com.enablebanking.ApiClient;

import com.enablebanking.api.AispApi;

import com.enablebanking.model.*;

// To be replaced with real connector settings class and set properties

ConnectorSettings connectorSettings = new SomeBankConnectorSettings();

AispApi aispApi = new AispApi(new ApiClient(connectorSettings));

HalBalances balances = aispApi.getAccountBalances("203059694928560295396833")

Retrieval of an account balances report (AISP)

Description

This call returns a set of balances for a given PSU account that is specified by the AISP through an account resource identification.- ASPSPs provide at least the accounting balance on the account.

- ASPSPs can provide other balance restitutions, e.g. instant balance, as well, if possible.

- Actually, from the PSD2 perspective, any other balances that are provided through the Web-Banking service of the ASPSP must also be provided by this ASPSP through the API.

Prerequisites

- Valid PSU access token shall be set in the connector.

- Consent ID shall be set in the connector.

- The TPP has previously retrieved the list of available accounts for the PSU.

Business flow

The AISP requests the ASPSP on one of the PSU’s accounts.The ASPSP answers by providing a list of balances on this account.

Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| accountResourceId | string | true | Identification of account resource to fetch |

Returned value

Data type: HalBalances

Returned value consists of the list of account balances.

Exceptions

| Data type | Description |

|---|---|

| HttpException | Raised when ASPSP API responses with unspecified error. |

| DataRetrievalException | Raised when unable to retrieve data requested from ASPSP API. |

| InsufficientScopeException | Raised when consent given by the PSU does not allow to retrieve requested data. |

| AccountNotAccessibleException | Raised when non accessible or inexsitent account transactions are requested. |

| InvalidResponseSignatureException | none |

getAccount

Retrieval of an account details (AISP)

Description

This call returns the details of a given PSU account that is specified by the AISP through an account resource identification.Prerequisites

- Valid PSU access token shall be set in the connector.

- Consent ID shall be set in the connector.

- The TPP has previously retrieved the list of available accounts for the PSU.

Business flow

The AISP requests the ASPSP on one of the PSU’s accounts.The ASPSP answers by providing the details of this account.

Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| accountResourceId | string | true | Identification of account resource to fetch |

Returned value

Data type: AccountResource

Returned value consists of the account details.

Exceptions

| Data type | Description |

|---|---|

| HttpException | Raised when ASPSP API responses with unspecified error. |

| DataRetrievalException | Raised when unable to retrieve data requested from ASPSP API. |

| InsufficientScopeException | Raised when consent given by the PSU does not allow to retrieve requested data. |

| AccountNotAccessibleException | Raised when non accessible or inexsitent account transactions are requested. |

| InvalidResponseSignatureException | none |

getAccountTransactions

Code samples

const enablebanking = require('enablebanking');

const aispApi = new enablebanking.AISPApi(

new enablebanking.ApiClient('ConnectorName', { /* Connector settings */ }));

const transactions = await aispApi.getAccountTransactions('203059694928560295396833');

import enablebanking

aisp_api = enablebanking.AISPApi(enablebanking.ApiClient(

'ConnectorName',

{

# Connector settings

}))

transactions = aisp_api.get_account_transactions('203059694928560295396833')

import com.enablebanking.ApiClient;

import com.enablebanking.api.AispApi;

import com.enablebanking.model.*;

// To be replaced with real connector settings class and set properties

ConnectorSettings connectorSettings = new SomeBankConnectorSettings();

AispApi aispApi = new AispApi(new ApiClient(connectorSettings));

HalTransactions transactions = aispApi.getAccountTransactions("203059694928560295396833");

Retrieval of an account transaction set (AISP)

Description

This call returns transactions for an account for a given PSU account that is specified by the AISP through an account resource identification. The request may use some filter parameter in order to restrict the query.Prerequisites

- Valid PSU access token shall be set in the connector.

- Consent ID shall be set in the connector.

- The TPP has previously retrieved the list of available accounts for the PSU.

Business flow

The AISP requests the ASPSP on one of the PSU’s accounts. It may specify some selection criteria. The ASPSP answers by a set of transactions that matches the query.Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| accountResourceId | string | true | Identification of account resource to fetch |

| dateFrom | string(date-time) | false | Inclusive minimal imputation date of the transactions. |

| dateTo | string(date-time) | false | Exclusive maximal imputation date of the transactions. |

| continuationKey | string | false | Specifies the value on which the result has to be computed. |

| transactionStatus | TransactionStatus | false | Transactions having a transactionStatus equal to this parameter are included within the result. |

Detailed descriptions

dateFrom: Inclusive minimal imputation date of the transactions.

Transactions having an imputation date equal to this parameter are included within the result.

dateTo: Exclusive maximal imputation date of the transactions.

Transactions having an imputation date equal to this parameter are not included within the result.

continuationKey: Specifies the value on which the result has to be computed.

Enumerated Values

transactionStatus

| Value | Description |

|---|---|

| BOOK | (ISO20022 ClosingBooked) Accounted transaction |

| CNCL | Cancelled transaction |

| HOLD | Account hold |

| OTHR | Transaction with unknown status or not fitting the other options |

| PDNG | (ISO20022 Expected) Instant Balance Transaction |

| RJCT | Rejected transaction |

| SCHD | Scheduled transaction |

Returned value

Data type: HalTransactions

Complete transactions response

Exceptions

| Data type | Description |

|---|---|

| HttpException | Raised when ASPSP API responses with unspecified error. |

| DataRetrievalException | Raised when unable to retrieve data requested from ASPSP API. |

| InsufficientScopeException | Raised when consent given by the PSU does not allow to retrieve requested data. |

| TransactionPeriodException | Raised when wrong or invalid account transactions period is requested. |

| AccountNotAccessibleException | Raised when non accessible or inexsitent account transactions are requested. |

| InvalidResponseSignatureException | none |

getTransactionDetails

Code samples

const enablebanking = require('enablebanking');

const aispApi = new enablebanking.AISPApi(

new enablebanking.ApiClient('ConnectorName', { /* Connector settings */ }));

const transactions = await aispApi.getTransactionDetails('203059694928560295396833', '797272616');

import enablebanking

aisp_api = enablebanking.AISPApi(enablebanking.ApiClient(

'ConnectorName',

{

# Connector settings

}))

transactions = aisp_api.get_transaction_details('203059694928560295396833', '797272616')

import com.enablebanking.ApiClient;

import com.enablebanking.api.AispApi;

import com.enablebanking.model.*;

// To be replaced with real connector settings class and set properties

ConnectorSettings connectorSettings = new SomeBankConnectorSettings();

AispApi aispApi = new AispApi(new ApiClient(connectorSettings));

HalTransactions transactions = aispApi.getTransactionDetails("203059694928560295396833","797272616");

Retrieval of an account transaction details (AISP)

Description

This call enables you to retrieve transaction details for a specific transaction, as designated by the Account Information Service Provider (AISP), using an account resource identification. The returned information provides comprehensive insights into the transactions associated with the specified account.Prerequisites

- Valid PSU access token shall be set in the connector.

- Consent ID shall be set in the connector.

- The TPP has previously retrieved the list of available accounts for the PSU.

Business flow

The AISP requests the ASPSP on the details of one of the PSU’s account transactions.The ASPSP answers by providing the details of this transaction.

Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| accountResourceId | string | true | Identification of account resource to fetch |

| transactionResourceId | string | true | Identification of a transaction resource to fetch |

Returned value

Data type: Transaction

Complete transactions details response

Exceptions

| Data type | Description |

|---|---|

| HttpException | Raised when ASPSP API responses with unspecified error. |

| DataRetrievalException | Raised when unable to retrieve data requested from ASPSP API. |

| InsufficientScopeException | Raised when consent given by the PSU does not allow to retrieve requested data. |

| TransactionPeriodException | Raised when wrong or invalid account transactions period is requested. |

| AccountNotAccessibleException | Raised when non accessible or inexsitent account transactions are requested. |

| InvalidResponseSignatureException | none |

modifyConsents

Code samples

const enablebanking = require('enablebanking');

const aispApi = new enablebanking.AISPApi(

new enablebanking.ApiClient('ConnectorName', { /* Connector settings */ }));

const consent = await aispApi.modifyConsents({

access: {

balances: ['203059694928560295396833'],

transactions: [],

trustedBeneficiaries: false,

psuIdentity: true

}

});

import enablebanking

aisp_api = enablebanking.AISPApi(enablebanking.ApiClient(

'ConnectorName',

{

# Connector settings

}))

consent = aisp_api.modify_consents(

access=enablebanking.Access(

# default access to balances

balances=enablebanking.BalancesAccess(),

# default access to transactions

transactions=enablebanking.TransacrionsAccess(),

trusted_beneficiaries=False,

psu_identity=True,

),

)

import com.enablebanking.ApiClient;

import com.enablebanking.api.AispApi;

import com.enablebanking.model.*;

// To be replaced with real connector settings class and set properties

ConnectorSettings connectorSettings = new SomeBankConnectorSettings();

AispApi aispApi = new AispApi(new ApiClient(connectorSettings));

Consent consent = aispApi.modifyConsents(

new Access()

.balances(new BalancesAccess()) // default access to balances

.transactions(new TransactionsAccess()) // default access to transactions

.trustedBeneficiaries(false)

.psuIdentity(true));

Forwarding the PSU consent (AISP)

Description

This call requests ASPSP to set the consent of an authenticated PSU. In the mixed detailed consent on accounts- the AISP captures the consent of the PSU

- then it forwards this consent to the ASPSP

Prerequisites

- Valid PSU access token shall be set in the connector.

- For ASPSPs allowing consent to be give only for specified accounts, the list of accounts shall be retrieved.

Business flow

The PSU specifies to the AISP which of his/her accounts will be accessible and which functionalities should be available. The AISP forwards these settings to the ASPSP.Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| state | string | false | Arbitrary String to be returned from to redirect URI |

| access | Access | false | List of consents granted to the AISP by the PSU. |

Returned value

Data type: Consent

Created or modified consent

Exceptions

| Data type | Description |

|---|---|

| ResponseValidationException | Raised when ASPSP API responses with unspecified error. |

deleteConsent

Deletes consent (AISP)

Description

Revokes PSU consent. After the consent is revoked, it becomes invalid and can not be used for futher API requests.Business flow

The PSU signals that he/she wants to revoke his consent for TPP to access account information. The TPP makes a request to the ASPSP to revoke PSU consent. The consent becomes invalid and its ID can not be used for consequent calls.Returned value

Data type: None

Consent successfully revoked

getCurrentConsent

Code samples

const enablebanking = require('enablebanking');

const aispApi = new enablebanking.AISPApi(

new enablebanking.ApiClient('ConnectorName', { /* Connector settings */ }));

const consent = await aispApi.getCurrentConsent();

import enablebanking

aisp_api = enablebanking.AISPApi(enablebanking.ApiClient(

'ConnectorName',

{

# Connector settings

}))

consent = aisp_api.get_current_consent()

import com.enablebanking.ApiClient;

import com.enablebanking.api.AispApi;

import com.enablebanking.model.*;

// To be replaced with real connector settings class and set properties

ConnectorSettings connectorSettings = new SomeBankConnectorSettings();

AispApi aispApi = new AispApi(new ApiClient(connectorSettings));

Consent consent = aispApi.getCurrentConsent();

Returns current consent (AISP)

Description

This call returns the consent current being used by the ASPSP connector, i.e. either explicitly set when the connector is initialized or as side effect produced by `getAuth` call.Returned value

Data type: Consent

Current consent used for accessing AIS APIs.

PISP API

makePaymentRequest

Code samples

const enablebanking = require('enablebanking');

const pispApi = new enablebanking.PISPApi(

new enablebanking.ApiClient('ConnectorName', { /* Connector settings */ }));

// Making payment request with credit transafer transaction of one element

const requestCreation = await pispApi.makePaymentRequest({

creditTransferTransaction: [{

instructedAmount: {

amount: '12.25', // amount

currency: 'EUR' // currency code

},

beneficiary: {

creditor: {

name: 'Creditor Name' // payee (merchant) name

},

creditorAccount: {

iban: 'FI4966010005485495' // payee account number

}

}

}],

debtor: {

name: 'Debtor Name' // payer (account holder) name

},

debtorAccount: {

iban: 'FI3839390001384700' // payer account number

}

}, null, null, null);

import enablebanking

pisp_api = enablebanking.PISPApi(enablebanking.ApiClient(

'ConnectorName',

{

# Connector settings

}))

# Making payment request with credit transafer transaction of one element

request_creation = pisp_api.make_payment_request(

enablebanking.PaymentRequestResource(

credit_transfer_transaction=[

enablebanking.CreditTransferTransaction(

instructed_amount=enablebanking.AmountType(

amount='12.25', # amount

currency='EUR'), # currency code

beneficiary=enablebanking.Beneficiary(

creditor=enablebanking.PartyIdentification(

name='Creditor Name'), # payee (merchant) name

creditor_account=enablebanking.AccountIdentification(

iban='FI4966010005485495'), # payee account number

),

),

],

debtor=enablebanking.PartyIdentification(

name='Debtor Name'), # payer (account holder) name

debtor_account=enablebanking.AccountIdentification(

iban='FI3839390001384700'), # payer account number

))

import java.math.BigDecimal;

import java.util.Arrays;

import com.enablebanking.ApiClient;

import com.enablebanking.api.PispApi;

import com.enablebanking.model.*;

// To be replaced with real connector settings class and set properties

ConnectorSettings connectorSettings = new SomeBankConnectorSettings();

PispApi pispApi = new PispApi(new ApiClient(connectorSettings));

// Making payment request with credit transafer transaction of one element

HalPaymentRequestCreation requestCreation = pispApi.makePaymentRequest(

new PaymentRequestResource()

.creditTransferTransaction(Arrays.asList(

new CreditTransferTransaction()

.instructedAmount(

new AmountType()

.currency("EUR")

.amount(new BigDecimal("12.25")))

.beneficiary(

new Beneficiary()

.creditor(

new PartyIdentification()

.name("Creditor Name"))

.creditorAccount(

new AccountIdentification()

.iban("FI4966010005485495")))))

.debtor(

new PartyIdentification()

.name("Debtor Name"))

.debtorAccount(

new AccountIdentification()

.iban("FI3839390001384700")), null, null, null);

Payment request initiation (PISP)

Description

The following use cases can be applied:- payment request on behalf of a merchant

- transfer request on behalf of the account's owner

- standing-order request on behalf of the account's owner

Data content

A payment request or a transfer request might embed several payment instructions having- one single execution date or multiple execution dates,

- one single beneficiary or multiple beneficiaries.

Business flow

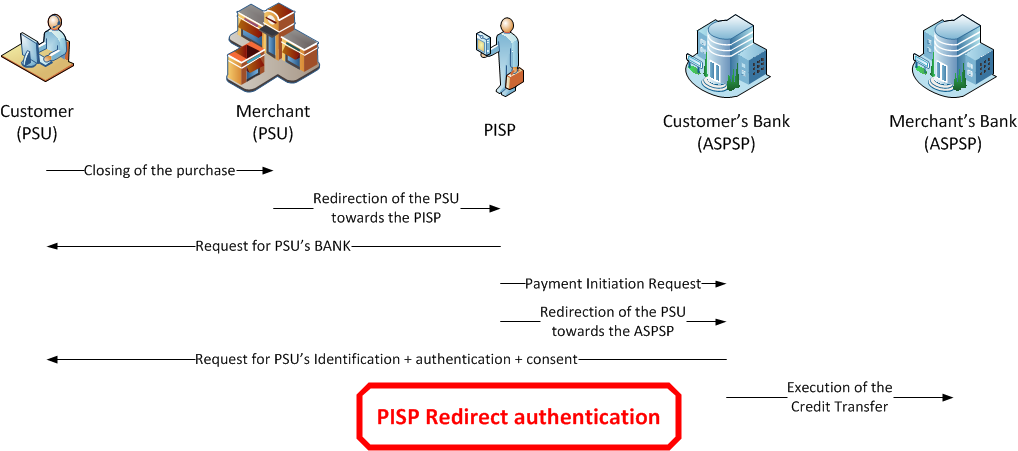

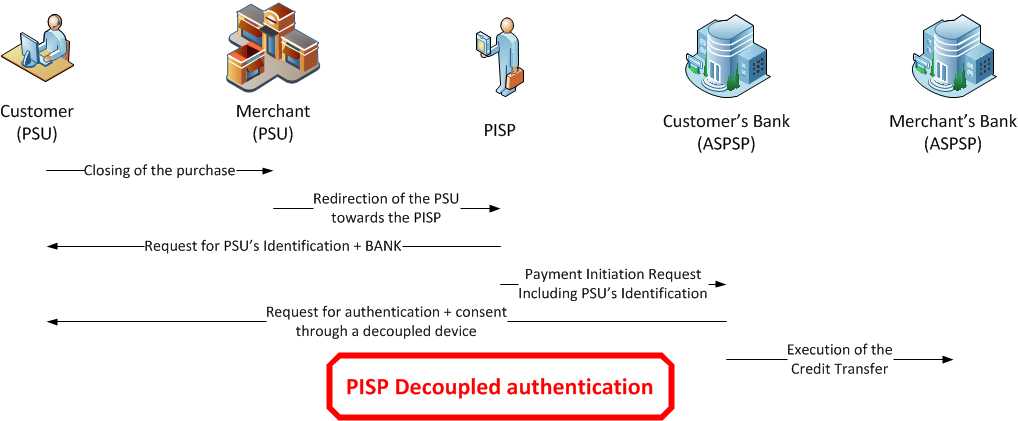

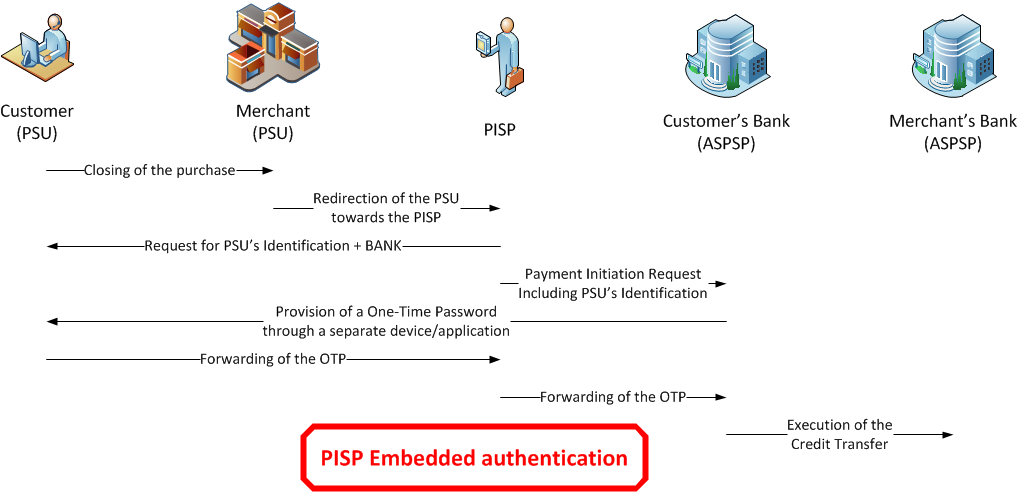

Payment Request use case

The PISP forwards a payment request on behalf of a merchant.The PSU buys some goods or services on an e-commerce website held by a merchant. Among other payment method, the merchant suggests the use of a PISP service. As there is obviously a contract between the merchant and the PISP, there is no need of such a contract between the PSU and this PISP to initiate the process.

Case of the PSU that chooses to use the PISP service:

- The merchant forwards the requested payment characteristics to the PISP and redirects the PSU to the PISP portal.

- The PISP requests from the PSU which ASPSP will be used.

- The PISP prepares the Payment Request and sends this request to the ASPSP.

- The Request can embed several payment instructions having different requested execution date.

- The beneficiary, as being the merchant, is set at the payment level.

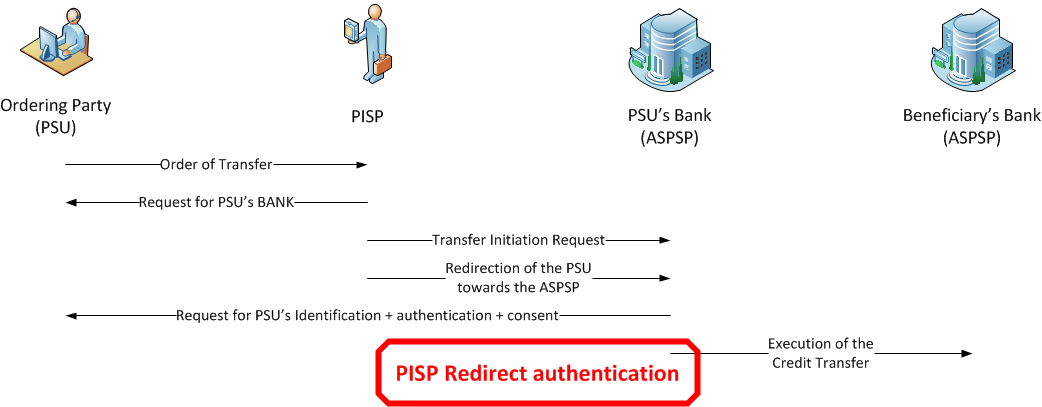

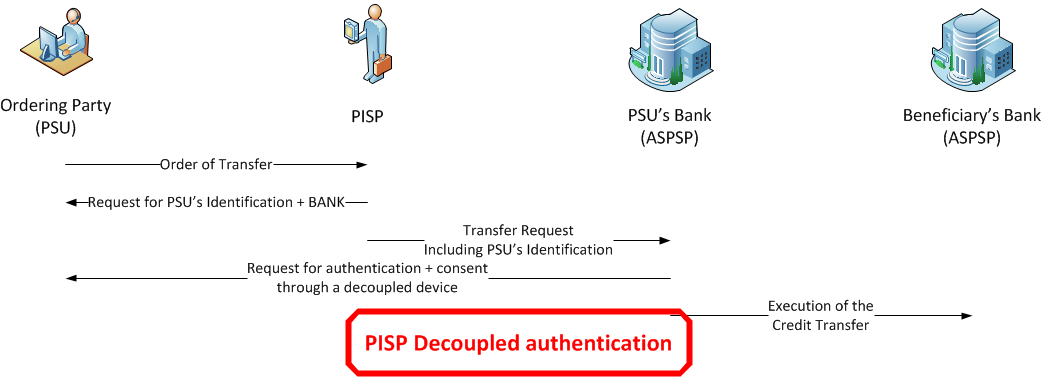

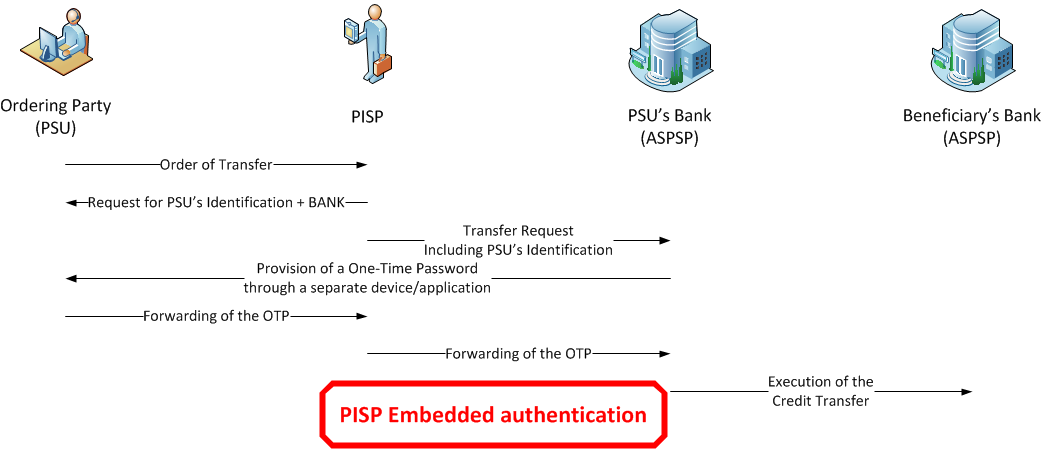

Transfer Request use case

The PISP forwards a transfer request on behalf of the owner of the account.- The PSU provides the PISP with all information needed for the transfer.

- The PISP prepares the Transfer Request and sends this request to the relevant ASPSP that holds the debtor account.

- The Request can embed several payment instructions having different beneficiaries.

- The requested execution date, as being the same for all instructions, is set at the payment level.

Standing Order Request use case

The PISP forwards a Standing Order request on behalf of the owner of the account.- The PSU provides the PISP with all information needed for the Standing Order.

- The PISP prepares the Standing Order Request and sends this request to the relevant ASPSP that holds the debtor account.

- The Request embeds one single payment instruction with

- The requested execution date of the first occurrence

- The requested execution frequency of the payment in order to compute further execution dates

- An execution rule to handle cases when the computed execution dates cannot be processed (e.g. bank holydays)

- An optional end date for closing the standing Order

Authentication flows for all use cases

As the request posted by the PISP to the ASPSP needs a PSU authentication before execution, this request will include:- The specification of the authentication approaches that are supported by both the PISP and the ASPSP (any combination of "REDIRECT", "EMBEDDED" and "DECOUPLED" values).

- In case of possible REDIRECT or DECOUPLED authentication approach, one or two callback URLs will be passed to the ASPSP at the finalisation of the authentication and consent process. The URLs are set in the connector settings.

- In case of possible "EMBEDDED" or "DECOUPLED" approaches, the PSU identifier that can be processed by the ASPSP for PSU recognition must have been set within the [debtor] structure.

- A resource identification of the accepted request that can be further used to retrieve the request and its status information.

- The specification of the chosen authentication approach taking into account both the PISP and the PSU capabilities.

- In case of chosen REDIRECT authentication approach, the URL to be used by the PISP for redirecting the PSU in order to perform a authentication.

Redirect authentication approach

When the authentication approach within the ASPSP answer is set to "REDIRECT":- The PISP redirects the PSU to the ASPSP which authenticates the PSU.

- The ASPSP asks the PSU to give (or deny) his/her consent to the payment request

- The PSU chooses or confirms which of his/her accounts shall be used by the ASPSP for the future credit transfer.

- The ASPSP is then able to initiate the subsequent credit transfer.

- The ASPSP redirects the PSU to the PISP using one of the callback URLs.

Decoupled authentication approach

When the authentication approach is "DECOUPLED":- Based on the PSU identifier provided within the payment request by the PISP, the ASPSP gives the PSU with the payment request details and challenges the PSU for a Strong Customer Authentication on a decoupled device or application.

- The PSU chooses or confirms which of his/her accounts shall be used by the ASPSP for the future credit transfer.

- The ASPSP is then able to initiate the subsequent credit transfer.

- The ASPSP notifies the PISP about the finalisation of the authentication and consent process by using one of the callback URLs.

Embedded authentication approach

When the authentication approach within the ASPSP answers is set to "EMBEDDED":- The TPP informs the PSU that a challenge is needed for completing the Payment Request processing. This challenge will be one of the following:

- A One-Time-Password sent by the ASPSP to the PSU on a separate device or application.

- A response computed by a specific device on base of a challenge sent by the ASPSP to the PSU on a separate device or application.

- The PSU unlocks the device or application through a "knowledge factor" and/or an "inherence factor" (biometric), retrieves the payment request details and processes the data sent by the ASPSP.

- The PSU might choose to confirm which of his/her accounts shall be used by the ASPSP for the future credit transfer when the device or application allows it.

- When agreeing the payment request, the PSU enters the resulting authentication factor through the PISP interface.

- The PISP shall confirm the payment request using the authentication factor received from the PSU.

Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| paymentType | string | true | Payment type. Can be either SEPA, INST_SEPA, DOMESTIC or CROSSBORDER |

| state | string | false | Arbitrary String to be returned from to redirect URI |

| credentials | array[string] | false | Array of user credentials which are required to log in to the bank (e.g. user ID, password, phone number etc) |

| method | string | false | Authentication method |

| paymentRequest | PaymentRequestResource | true | ISO20022 based payment Initiation Request |

Returned value

Data type: HalPaymentRequestCreation

The request has been created as a resource. The ASPSP must authenticate the PSU.

Exceptions

| Data type | Description |

|---|---|

| HttpException | Raised when ASPSP API responses with unspecified error. |

initiatePaymentRequestCancellation

Payment request cancellation (PISP)

Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| paymentRequestResourceId | string | true | Identification of the Payment Request Resource |

| state | string | false | Arbitrary String to be returned from to redirect URI |

| credentials | array[string] | false | Array of user credentials which are required to log in to the bank (e.g. user ID, password, phone number etc) |

| method | string | false | Authentication method |

Returned value

Data type: HalPaymentRequestCancellation

Cancellation successful

executePaymentRequestCancellation

Confirmation of a payment request or a modification request (PISP)

Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| paymentRequestResourceId | string | true | Identification of the Payment Request Resource |

| confirmation | PaymentRequestConfirmation | false | Data needed for confirmation of the Payment Request, especially in EMBEDDED approach |

Detailed descriptions

confirmation: Data needed for confirmation of the Payment Request, especially in EMBEDDED approach

Returned value

Data type: HalPaymentReuqestCancellationResult

retrieval of the Payment Cancellation enriched with the status report

Exceptions

| Data type | Description |

|---|---|

| HttpException | Raised when ASPSP API responses with unspecified error. |

validatePaymentRequest

Payment request initiation (PISP)

Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| paymentType | string | true | Payment type. Can be either SEPA, INST_SEPA, DOMESTIC or CROSSBORDER |

| skipDebtorAccountValidation | boolean | false | Flag whether to skip debtor account validation |

| paymentRequest | PaymentRequestResource | true | ISO20022 based payment Initiation Request |

Returned value

Data type: None

Validation successful

getPaymentRequest

Retrieval of a payment request (PISP)

Description

The following use cases can be applied:- retrieval of a payment request on behalf of a merchant

- retrieval of a transfer request on behalf of the account's owner

- retrieval of a standing-order request on behalf of the account's owner

The ASPSP has registered the request, updated if necessary the relevant identifiers in order to avoid duplicates and returned the updated request.

The PISP gets the request that might have been updated with the resource identifiers, the status of the payment/transfer request and the status of the subsequent credit transfer.

Prerequisites

- The TPP has previously posted a payment request which has been accepted by the ASPSP.

Business flow

The PISP asks to retrieve the payment/transfer request that has been accepted by the ASPSP. The PISP uses the payment request identifier provided by the ASPSP in response to the payment request.The ASPSP returns the previously accepted payment/transfer request, which is enriched with:

- The resource identifiers given by the ASPSP

- The status information of the Payment Request and of the subsequent credit transfer

Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| paymentRequestResourceId | string | true | Identification of the Payment Request Resource |

Returned value

Data type: HalPaymentRequest

Retrieval of the previously posted Payment Request

Exceptions

| Data type | Description |

|---|---|

| HttpException | Raised when ASPSP API responses with unspecified error. |

getPaymentRequestTransaction

Retrieval of a payment request transaction (PISP)

Description

The PISP retrieves the transaction that has been initiated by the payment request.Prerequisites

- The TPP has previously posted a payment request which has been accepted by the ASPSP.

- The TPP has retrieved the accepted payment request in order to get the relevant resource IDs.

Business flow

The PISP asks to retrieve the transaction that has been initiated by the payment request. The PISP uses the payment request identifier provided by the ASPSP in response to the payment request.The ASPSP returns the previously initiated transaction.

Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| paymentRequestResourceId | string | true | Identification of the Payment Request Resource |

| paymentRequestTransactionResourceId | string | true | Identification of the Payment Request Transaction Resource |

Returned value

Data type: HalPaymentRequestTransaction

Retrieval of the previously initiated transaction

makePaymentRequestConfirmation

Confirmation of a payment request or a modification request (PISP)

Description

The PISP confirms one of the following requests- payment request on behalf of a merchant

- transfer request on behalf of the account's owner

- standing-order request on behalf of the account's owner

Prerequisites

- The TPP has previously set a request which has been accepted by the ASPSP.

- The TPP has retrieved the accpeted request in order to get the relevant resource IDs.

- The TPP provided the PSU necessary information and means for SCA required before the confirmation.

Business flow

Once the PSU has been authenticated, it is the due to the PISP to confirm the Request to the ASPSP in order to complete the process flow.In REDIRECT and DECOUPLED approach, this confirmation is not a prerequisite to the execution of the Credit Transfer.

Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| paymentRequestResourceId | string | true | Identification of the Payment Request Resource |

| confirmation | PaymentRequestConfirmation | false | Data needed for confirmation of the Payment Request, especially in EMBEDDED approach |

Detailed descriptions

confirmation: Data needed for confirmation of the Payment Request, especially in EMBEDDED approach

Returned value

Data type: HalPaymentRequest

retrieval of the Payment Request enriched with the status report

Exceptions

| Data type | Description |

|---|---|

| HttpException | Raised when ASPSP API responses with unspecified error. |

CBPII API

makeFundsConfirmation

Payment coverage check request (CBPII)

Description

The CBPII can ask an ASPSP to check if a given amount can be covered by the liquidity that is available on a PSU cash account or payment card.Business flow

The CBPII requests the ASPSP for a payment coverage check against either a bank account or a card primary identifier.The ASPSP answers with a structure embedding the original request and the result as a Boolean.

Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| paymentCoverage | PaymentCoverageRequestResource | true | parameters of a payment coverage request |

Returned value

Data type: HalPaymentCoverageReport

payment coverage request

Data types

Access

Requested access services.

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

accounts |

false |

List of accounts access to which is requested. If not set behaviour depends on the bank: some banks allow users to choose list of accessible accounts through their access consent UI, while other may provide access to all accounts or just access to the list of accounts. |

|

|

balances |

boolean |

false |

Defines whether balance information is requested. |

|

transactions |

boolean |

false |

Defines whether transactions information is requested. |

|

transactionsLimitDays |

integer |

false |

Defines the maximum number of days for which transactions are requested. Zero means no explicit limit. |

|

paymentInitiation |

boolean |

false |

Defines whether access to payments initiation is requested. |

|

trustedBeneficiaries |

boolean |

false |

Indicator that access to the trusted beneficiaries list was requested or not to the AISP by the PSU

|

|

recurringIndicator |

boolean |

false |

|

|

frequencyPerDay |

integer |

false |

This field indicates the requested maximum frequency for an access without PSU involvement per day. For a one-off access, this attribute is set to "1". The frequency needs to be greater equal to one. |

|

validUntil |

string(date-time) |

false |

This parameter is requesting a valid until date for the requested consent. The content is the local ASPSP date in ISO-Date Format, e.g. 2017-10-30. Future dates might get adjusted by ASPSP. |

AccountIdentification

Unique and unambiguous identification for the account between the account owner and the account servicer.

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

iban |

string |

false |

ISO20022: International Bank Account Number (IBAN) - identification used internationally by financial institutions to uniquely identify the account of a customer. Further specifications of the format and content of the IBAN can be found in the standard ISO 13616 "Banking and related financial services - International Bank Account Number (IBAN)" version 1997-10-01, or later revisions. |

|

other |

false |

ISO20022: Unique identification of an account, a person or an organisation, as assigned by an issuer. |

AccountResource

PSU account that is made available to the TPP

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

resourceId |

false |

Identifier assigned by the ASPSP for further use of the created resource through API calls |

|

|

accountServicer |

false |

ISO20022: Unique and unambiguous identification of a financial institution, as assigned under an internationally recognised or proprietary identification scheme. |

|

|

accountId |

false |

Unique and unambiguous identification for the account between the account owner and the account servicer. |

|

|

allAccountIds |

false |

All account identifiers provided by ASPSPs (including primary identifier available in the accountId field) |

|

|

name |

string |

false |

Account holder(s) name |

|

details |

string |

false |

Account description set by PSU or provided by ASPSP |

|

usage |

string |

false |

Specifies the usage of the account |

|

cashAccountType |

string |

true |

Specifies the type of the account |

|

product |

string |

false |

Product Name of the Bank for this account, proprietary definition |

|

currency |

true |

Currency used for the account |

|

|

creditLimit |

false |

ISO20022: structure aiming to carry either an instructed amount or equivalent amount. Both structures embed the amount and the currency to be used. |

|

|

balances |

false |

list of balances provided by the ASPSP |

|

|

psuStatus |

string |

false |

Relationship between the PSU and the account - Account Holder - Co-account Holder - Attorney |

|

postalAddress |

false |

ISO20022 : Information that locates and identifies a specific address, as defined by postal services. |

Enumerated Values

usage

| Value | Description |

|---|---|

|

PRIV |

private personal account |

|

ORGA |

professional account |

cashAccountType

| Value | Description |

|---|---|

|

CACC |

Account used to post debits and credits when no specific account has been nominated |

|

CASH |

Account used for the payment of cash |

|

CARD |

Account used for card payments only |

|

LOAN |

Account used for loans |

|

SVGS |

Account used for savings |

|

OTHR |

Account not otherwise specified |

AddressType

ISO20022: Identifies the nature of the postal address.

Base type

string

Enumerated Values

| Value | Description |

|---|---|

|

Business |

— |

|

Correspondence |

— |

|

DeliveryTo |

— |

|

MailTo |

— |

|

POBox |

— |

|

Postal |

— |

|

Residential |

— |

|

Statement |

— |

AmountType

ISO20022: structure aiming to carry either an instructed amount or equivalent amount. Both structures embed the amount and the currency to be used.

API: only instructed amount can be used

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

currency |

true |

Specifies the currency of the amount or of the account. |

|

|

amount |

string(number) |

true |

ISO20022: Amount of money to be moved between the debtor and creditor, before deduction of charges, expressed in the currency as ordered by the initiating party. |

Auth

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

url |

string |

false |

URL for authorization. Used for REDIRECT authorization flow |

|

env |

string |

false |

Additional authorization environment data. To be passed to makeToken. |

|

authData |

false |

[structure used for returning auth parameters to be passed to user] |

AuthDataItem

structure used for returning auth parameters to be passed to user

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

type |

string |

false |

Type of the auth data item |

|

value |

string |

false |

Value of auth data item |

Enumerated Values

type

| Value | Description |

|---|---|

|

otpIndex |

— |

|

message |

— |

|

APP |

— |

|

IMAGE_LINK |

— |

|

IMAGE_RENDER |

— |

|

IMAGE_B64 |

— |

AuthInfo

Information about usage of getAuth method

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

access |

boolean |

true |

Shows if access parameter is supported in |

|

credentials |

false |

Shows necessary credentials needed to provide in |

|

|

authData |

boolean |

false |

Shows if |

|

authUrlHints |

true |

Shows which actions can be done with url returned from |

|

|

brands |

[Brand] |

false |

List of brands used by the ASPSP (in a certain country) |

AuthRedirect

structure used for returning parameters of redirect url

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

code |

string |

false |

redirect code received from a bank |

|

id_token |

string |

false |

Id of token received from a bank |

|

state |

string |

false |

state specified by TPP |

|

error |

string |

false |

error message |

|

error_description |

string |

false |

error description |

|

consent_id |

string |

false |

consent id |

AuthUrlHint

Auxiliary data structure binding information about usage of an url returned from getAuth method

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

authType |

false |

Action which can be done with url returned from |

|

|

refresh |

boolean |

true |

Shows if the url needs to be refreshed |

|

refreshFrequency |

integer |

false |

Shows how often the url needs to be refreshed. Applicable only if refresh is true |

AuthUrlType

Action which can be done with url returned from getAuth

Base type

string

Enumerated Values

| Value | Description |

|---|---|

|

REDIRECT |

PSU needs to be redirected to the URL |

|

IFRAME |

the url needs to be displayed in an iframe |

|

APP |

the url needs to be opened in a mobile app |

|

IMAGE_LINK |

Link to an image which needs to be displayed |

|

IMAGE_RENDER |

Image data which needs to be displayed |

|

IMAGE_B64 |

Image data in base64 format which needs to be displayed |

AuthenticationApproach

The ASPSP, based on the authentication approaches proposed by the PISP, choose the one that it can processed, in respect with the preferences and constraints of the PSU and indicates in this field which approach has been chosen

Base type

string

Enumerated Values

| Value | Description |

|---|---|

|

REDIRECT |

the PSU is redirected by the TPP to the ASPSP which processes identification and authentication |

|

DECOUPLED |

the TPP identifies the PSU and forwards the identification to the ASPSP which processes the authentication through a decoupled device |

|

EMBEDDED |

the TPP identifies the PSU and forwards the identification to the ASPSP which starts the authentication. The TPP forwards one authentication factor of the PSU (e.g. OTP or response to a challenge) |

BalanceResource

Structure of an account balance

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

name |

string |

true |

Label of the balance |

|

balanceAmount |

true |

ISO20022: structure aiming to carry either an instructed amount or equivalent amount. Both structures embed the amount and the currency to be used. |

|

|

balanceType |

true |

Type of balance |

|

|

lastChangeDateTime |

string(date-time) |

false |

Timestamp of the last change of the balance amount |

|

referenceDate |

string(date) |

false |

Reference date for the balance |

|

lastCommittedTransaction |

string |

false |

Identification of the last committed transaction. This is actually useful for instant balance. |

BalanceStatus

Type of balance

Base type

string

Enumerated Values

| Value | Description |

|---|---|

|

CLAV |

(ISO20022 Closing Available) Closing available balance |

|

CLBD |

(ISO20022 ClosingBooked) Accounting Balance |

|

FWAV |

(ISO20022 ForwardAvailable) Balance of money that is at the disposal of the account owner on the date specified |

|

INFO |

(ISO20022 Information) Balance for informational purposes |

|

ITAV |

(ISO20022 InterimAvailable) Available balance calculated in the course of the day |

|

ITBD |

(ISO20022 InterimBooked) Booked balance calculated in the course of the day |

|

OPAV |

(ISO20022 OpeningAvailable) Opening balance of amount of money that is at the disposal of the account owner on the date specified |

|

OPBD |

(ISO20022 OpeningBooked) Book balance of the account at the beginning of the account reporting period. It always equals the closing book balance from the previous report |

|

PRCD |

(ISO20022 PreviouslyClosedBooked) Balance of the account at the end of the previous reporting period |

|

OTHR |

Other Balance |

|

VALU |

Value-date balance |

|

XPCD |

(ISO20022 Expected) Instant Balance |

BankTransactionCode

ISO20022: Allows the account servicer to correctly report a transaction, which in its turn will help account owners to perform their cash management and reconciliation operations.

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

description |

string |

false |

Transaction type description |

|

code |

string |

false |

ISO20022: Specifies the family of a transaction within the domain |

|

subCode |

string |

false |

ISO20022: Specifies the sub-product family of a transaction within a specific family |

Beneficiary

Specification of a beneficiary

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

creditorAgent |

false |

ISO20022: Unique and unambiguous identification of a financial institution, as assigned under an internationally recognised or proprietary identification scheme. |

|

|

creditor |

false |

API : Description of a Party which can be either a person or an organization. |

|

|

creditorAccount |

true |

Unique and unambiguous identification for the account between the account owner and the account servicer. |

|

|

creditorCurrency |

string |

false |

Creditor account currency code |

BookingInformation

indicator that the payment can be immediately booked or not

- true: payment is booked

- false: payment is not booked

Base type

boolean

Brand

Information about ASPSP end-user recognizable brand

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

name |

string |

true |

End-customer facing name |

|

logos |

[Logo] |

false |

List of available logos |

|

bic |

string |

false |

ASPSP BIC |

CategoryPurposeCode

ISO20022: Specifies the high level purpose of the instruction based on a set of pre-defined categories. This is used by the initiating party to provide information concerning the processing of the payment. It is likely to trigger special processing by any of the agents involved in the payment chain.

Base type

string

Enumerated Values

| Value | Description |

|---|---|

|

BONU |

BonusPayment Transaction is the payment of a bonus. |

|

CASH |

CashManagementTransfer Transaction is a general cash management instruction. |

|

CBLK |

Card Bulk Clearing A Service that is settling money for a bulk of card transactions, while referring to a specific transaction file or other information like terminal ID, card acceptor ID or other transaction details. |

|

CCRD |

Credit Card Payment Transaction is related to a payment of credit card. |

|

CORT |

TradeSettlementPayment Transaction is related to settlement of a trade, eg a foreign exchange deal or a securities transaction. |

|

DCRD |

Debit Card Payment Transaction is related to a payment of debit card. |

|

DIVI |

Dividend Transaction is the payment of dividends. |

|

DVPM |

DeliverAgainstPayment Code used to pre-advise the account servicer of a forthcoming deliver against payment instruction. |

|

EPAY |

Epayment Transaction is related to ePayment. |

|

FCOL |

Fee Collection A Service that is settling card transaction related fees between two parties. |

|

GOVT |

GovernmentPayment Transaction is a payment to or from a government department. |

|

HEDG |

Hedging Transaction is related to the payment of a hedging operation. |

|

ICCP |

Irrevocable Credit Card Payment Transaction is reimbursement of credit card payment. |

|

IDCP |

Irrevocable Debit Card Payment Transaction is reimbursement of debit card payment. |

|

INTC |

IntraCompanyPayment Transaction is an intra-company payment, ie, a payment between two companies belonging to the same group. |

|

INTE |

Interest Transaction is the payment of interest. |

|

LOAN |

Loan Transaction is related to the transfer of a loan to a borrower. |

|

MP2B |

Commercial Mobile P2B Payment |

|

MP2P |

Consumer Mobile P2P Payment |

|

OTHR |

OtherPayment Other payment purpose. |

|

PENS |

PensionPayment Transaction is the payment of pension. |

|

RPRE |

Represented Collection used to re-present previously reversed or returned direct debit transactions. |

|

RRCT |

ReimbursementReceivedCreditTransfer Transaction is related to a reimbursement for commercial reasons of a correctly received credit transfer. |

|

RVPM |

ReceiveAgainstPayment Code used to pre-advise the account servicer of a forthcoming receive against payment instruction. |

|

SALA |

SalaryPayment Transaction is the payment of salaries. |

|

SECU |

Securities Transaction is the payment of securities. |

|

SSBE |

SocialSecurityBenefit Transaction is a social security benefit, ie payment made by a government to support individuals. |

|

SUPP |

SupplierPayment Transaction is related to a payment to a supplier. |

|

TAXS |

TaxPayment Transaction is the payment of taxes. |

|

TRAD |

Trade Transaction is related to the payment of a trade finance transaction. |

|

TREA |

TreasuryPayment Transaction is related to treasury operations. E.g. financial contract settlement. |

|

VATX |

ValueAddedTaxPayment Transaction is the payment of value added tax. |

|

WHLD |

WithHolding Transaction is the payment of withholding tax. |

ChargeBearerCode

ISO20022: Specifies which party/parties will bear the charges associated with the processing of the payment transaction.

Base type

string

Enumerated Values

| Value | Description |

|---|---|

|

SLEV |

Service level. Charges are to be applied following the rules agreed in the service level and/or scheme. |

|

SHAR |

Shared. |

|

DEBT |

The Payer (sender of the payment) will bear all of the payment transaction fees. |

|

CRED |

The Payee (recipient of the payment) will incur all of the payment transaction fees. |

ClearingSystemMemberIdentification

ISO20022: Information used to identify a member within a clearing system. API: to be used for some specific international credit transfers in order to identify the beneficiary bank

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

clearingSystemId |

string |

false |

ISO20022: Specification of a pre-agreed offering between clearing agents or the channel through which the payment instruction is processed. |

|

memberId |

string |

false |

ISO20022: Identification of a member of a clearing system. |

ClientInfo

Client Data.

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

psuIpAddress |

string |

false |

IP address used by the PSU's terminal when connecting to the TPP |

|

psuIpPort |

string |

false |

IP port used by the PSU's terminal when connecting to the TPP |

|

psuHttpMethod |

string |

false |

Http method for the most relevant PSU’s terminal request to the TTP |

|

psuDate |

string |

false |

Timestamp of the most relevant PSU’s terminal request to the TTP |

|

psuUserAgent |

string |

false |

"User-Agent" header field sent by the PSU terminal when connecting to the TPP |

|

psuReferer |

string |

false |

"Referer" header field sent by the PSU terminal when connecting to the TPP. Notice that an initial typo in RFC 1945 specifies that "referer" (incorrect spelling) is to be used. The correct spelling "referrer" can be used but might not be understood. |

|

psuAccept |

string |

false |

"Accept" header field sent by the PSU terminal when connecting to the TPP |

|

psuAcceptCharset |

string |

false |

"Accept-Charset" header field sent by the PSU terminal when connecting to the TPP |

|

psuAcceptEncoding |

string |

false |

"Accept-Encoding" header field sent by the PSU terminal when connecting to the TPP |

|

psuAcceptLanguage |

string |

false |

"Accept-Language" header field sent by the PSU terminal when connecting to the TPP |

|

psuGeoLocation |

string |

false |

Geographical location of the PSU as provided by the PSU mobile terminal if any to the TPP |

|

psuDeviceId |

string |

false |

UUID (Universally Unique Identifier) for a device, which is used by the PSU, if available. UUID identifies either a device or a device dependant application installation. In case of installation identification this ID need to be unaltered until removal from device. |

|

psuLastLoggedTime |

string |

false |

The time when the PSU last logged in with the TPP. |

Connector

Information about the connector used for interaction with ASPSPs

Fields

| Name | Type | Required | Description |

|---|---|---|---|

|

name |

string |

true |

Name of the connector |

|

environments |

[string] |

true |

List of supported environments (sandbox/production) |

|

countries |

[string] |

true |

List of supported countries |

|

languages |

[string] |

false |

List of supported languages |

|

scopes |

[string] |